The growing complexity in Ethereum price trend over the $2,000 level warns of increased volatility. Will a post-retest reversal navigate a rally to $2,500?

Amid the growing anticipation of the crypto market reclaiming a $3 trillion valuation, Ethereum maintains dominance above the $2,000 mark. After recently retesting the psychological $2,000 level, Ethereum is trading at $2,954, with an intraday pullback of 1.28%.

However, a lower price rejection and a short-term recovery on the 4-hour chart suggest a potential bounce-back. Will this post-retest reversal help Ethereum reach the $2,500 mark?

Ethereum Price Analysis Hints Extended Recovery

On the 4-hour price chart, Ethereum’s price trend shows a reversal rally with a breakout from a consolidation range. Ethereum marked an upswing near the $2,100 level, crossing above the 100 EMA line.

However, a higher price rejection has led to a retest of the 100 EMA line near the $2,000 psychological level. Despite this minor setback, the overall trend remains bullish, with the uptrend maintaining its bullish momentum.

The short-term recovery also increases the likelihood of a positive crossover between the 50 and 100 EMA lines.

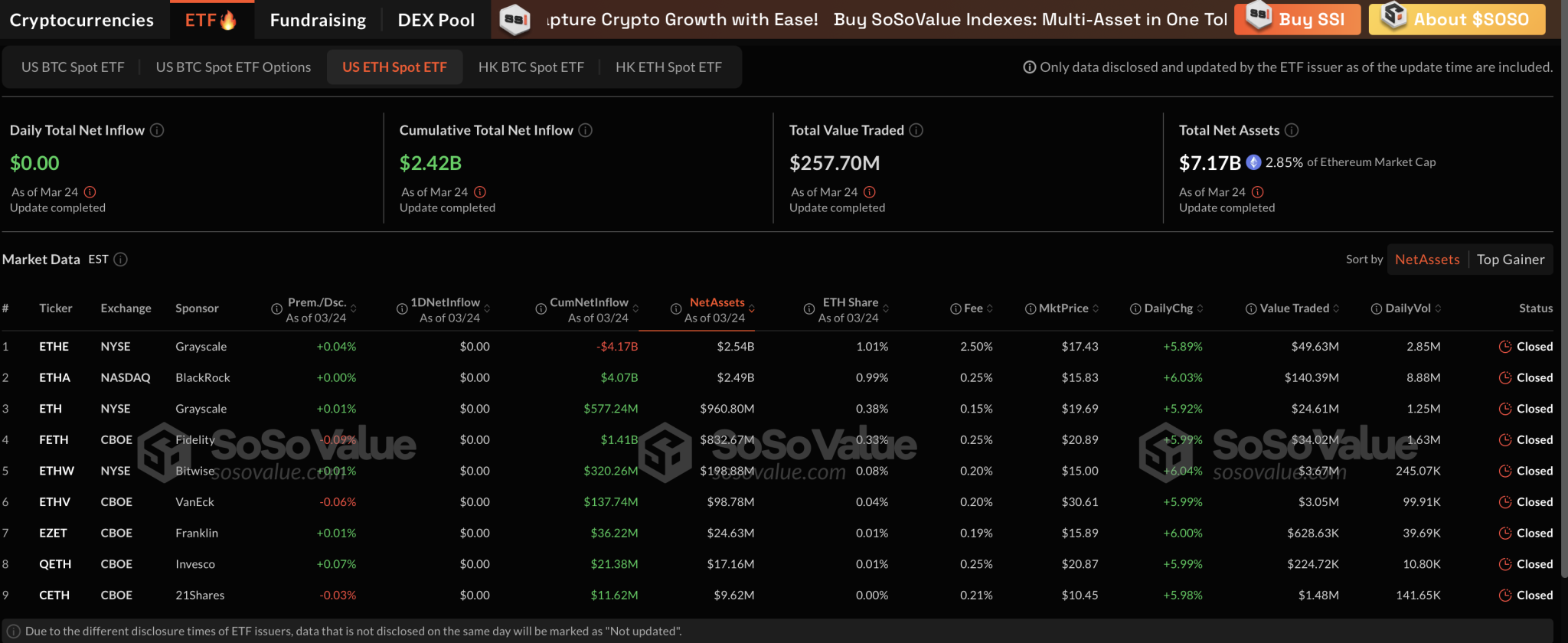

Ethereum ETFs Mark Net Zero Flow

As Ethereum’s price trend hints at a potential bounce-back, institutional investment in the token reported a net-zero flow on March 24. This marks the seventh day of net-zero flow since the inception of Ethereum ETFs in the U.S. market.

Currently, the total net assets held by Ethereum ETFs amount to $7.17 billion, or 2.85% of Ethereum’s market cap. Meanwhile, the cumulative net inflow stands at $2.42 billion since inception.

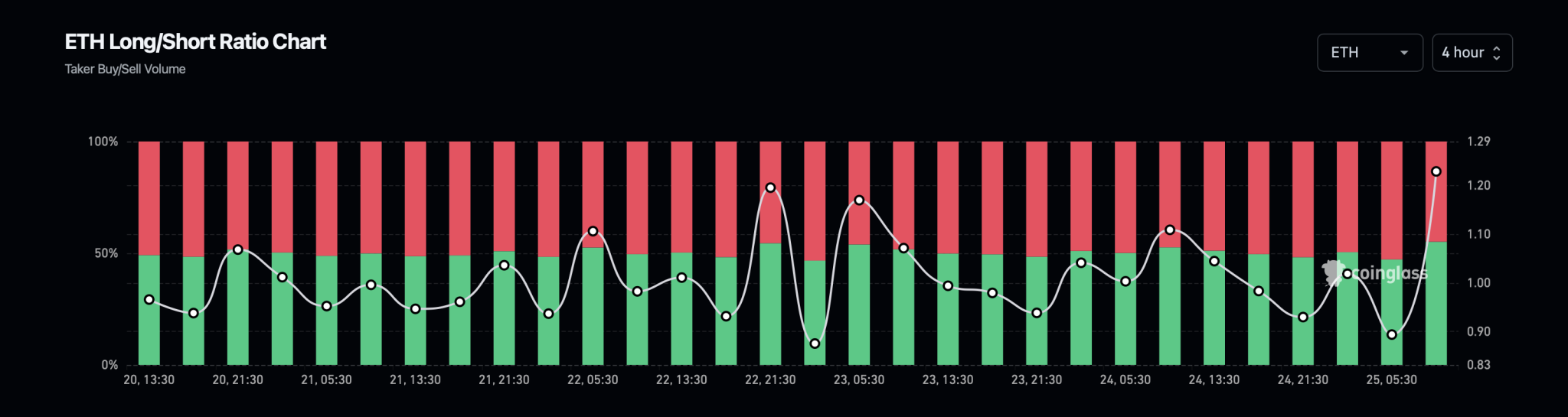

Bulls Gain Momentum Amid Post-Retest Reversal

With short-term recovery and growing prospects of a bull run, sentiment in the Ethereum derivatives market is turning bullish. The Ethereum long/short ratio chart shows that long positions have risen to 55% of total contracts in the past four hours.

This brings the long-to-short ratio to 1.2287, reflecting a significant increase in bullish positions. Furthermore, the open interest of Ethereum derivatives has increased to $21.75 billion, showing a 3.21% surge, with a positive funding rate of 0.0026%.

Analysts Target Extended Recovery in ETH Prices

As Ethereum shows signs of recovery, crypto analyst Gert van Lagen has highlighted the potential formation of an inverted head-and-shoulders pattern on the weekly chart. According to the analyst, with Ethereum bouncing off the $1,800-$2,000 support level, the price trend is close to completing the bullish pattern.

The short-term recovery could mark the start of the right shoulder of the pattern, with the neckline positioned near the $4,000 psychological mark.

$ETH [1W] bounces off the ~$1800-$2000 support range while having formed a complex iH&S structure, targeting ~$18k.

This support level acted as resistance during the 'head' phase. Now price successfully retested it as support.

Now the Left and Right shoulders are well-aligned. pic.twitter.com/909aRoeajD

— Gert van Lagen (@GertvanLagen) March 24, 2025

Meanwhile, Michael van de Poppe identifies crucial resistance in Ethereum’s short-term recovery. The analyst highlights a supply zone between $2,100 and $2,150.

A bullish breakout above this supply zone could drive Ethereum to a 30% surge, potentially reaching the $2,800 mark.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.