Meteoric price rallies from Bitcoin and Ethereum dealt severe blows to bears, with liquidation figures reaching multi-year highs.

The cryptocurrency market added over $235 billion in the past day as the sector continues its recovery process. The rally pushed the industry’s valuation to $3.25 trillion, with bears in shambles.

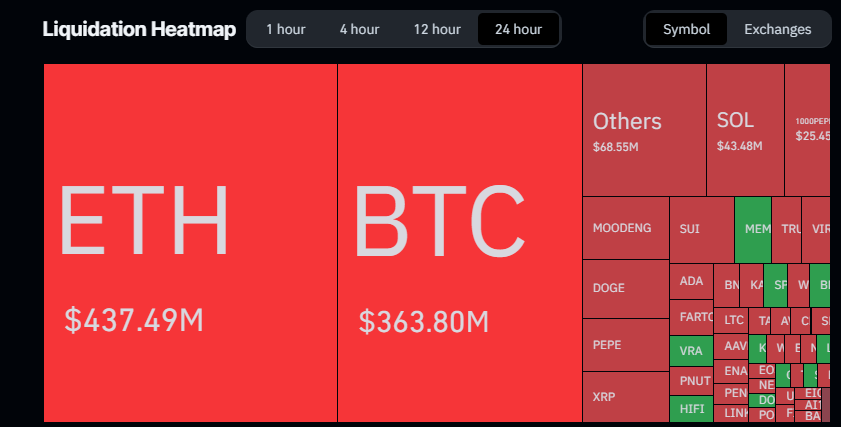

Data from Coinglass highlighted a bear battering in the past 24 hours, with short liquidation reaching insane levels. Specifically, traders betting on lower Bitcoin and altcoin prices suffered losses reaching $871 million, the largest since July 2021.

Liquidation Frenzy

While bulls suffered considerable losses, bears predominated the liquidation frenzy. For perspective, about $1.17 billion worth of leveraged positions were chalked off the crypto market in the past 24 hours, with 74% worth $871 million in shorts and 26% ($300 million) in longs.

Meanwhile, Ethereum bears suffered the most losses following the asset’s over 20% rally in the past day. The altcoin king surged from sub-$2,000 to a three-month high of $2,490, liquidating $300 million in leveraged short bets. Notably, $136.74 million worth of long positions also left the market, totaling $437.49 million.

Bitcoin bears also felt the heat, accounting for 91% of all BTC liquidated positions. Today’s 5% rally to above $104,000 ensured that $330 million of the $363.80 million worth of positions affected were bearish bets.

Other notable assets with massive liquidation figures include Solana, Pepe, and, surprisingly, MOODENG. An 11%, 35%, and a staggering 152% uptick ensured that $34.7 million, $17.56 million, and $14.85 million worth of bear positions were liquidated, respectively.

Remarkably, Coinglass noted that Binance did not fully disclose its data, suggesting there might be higher statistics than displayed. Meanwhile, the largest singular liquidation in the past 24 hours came from a whale, who lost $11.97 million on the BTC/USDT pair on Binance.

Easing Selling Pressure Suggests More Upsides

For context, CryptoQuant’s CEO, Ki Young Ju, highlighted easing Bitcoin’s selling pressure as a catalyst for this price acceleration. He noted in a tweet that whales did not just stop selling; massive inflows from institutions and US exchange-traded funds (ETFs) have accelerated.

Two months ago, I said the bull cycle was over, but I was wrong. #Bitcoin selling pressure is easing, and massive inflows are coming through ETFs.

In the past, the Bitcoin market was pretty simple. The main players were old whales, miners, and new retail investors, basically… pic.twitter.com/oN4n6vNc0s

— Ki Young Ju (@ki_young_ju) May 9, 2025

While admitting to his earlier wrong disposition, he stressed that the crypto market dynamics have evolved from old whales and retail passing around Bitcoin to a more diverse setting with growing capital influx from institutions and even governments.

Meanwhile, with market indicators slowly turning bullish, analysis suggests Bitcoin may see further upside. Moreover, prominent market participants have predicted prices like $120,000 before the end of Q2 and $200,000 by the end of the year.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.