Bitcoin has continued to set new records this week, closing at an unprecedented price mark on the daily timeframe in its 15-year history.

Bitcoin looks supercharged, as bullish momentum predominates. After a slight scare on Monday, the largest cryptocurrency by market cap resumed its uptrend yesterday, closing with a mild 1.18% uptick.

Interestingly, the May 20 close marked a notable milestone for Bitcoin. Notably, the asset has never closed that high on the daily timeframe since it started trading in 2010. This reflects both momentum and bullish traction, setting Bitcoin up for more landmark prices.

Highest Ever Daily Closing in History

Barchar, a prominent financial market analytical provider, highlighted in a tweet today that Bitcoin recently recorded its highest-ever daily close in history. The pioneering cryptocurrency closed May 20 at $106,909, breaking the record from two days ago when it closed at $106,487.

Meanwhile, the coveted daily record follows Bitcoin’s historic weekly closing. Last week, the crypto leader closed at $106,487, its highest-ever seven-day close in history. Notably, the sustained bullish price action has set the precedent for Bitcoin to continue its foray into price discovery.

Massive Liquidation Awaits Bears with Sustained Momentum

Notably, Bitcoin has continued the upsurge today, rallying to an intraday high of $108,010. Remarkably, it last traded at this level on January 20, the day it reached its current all-time high of $109,354.

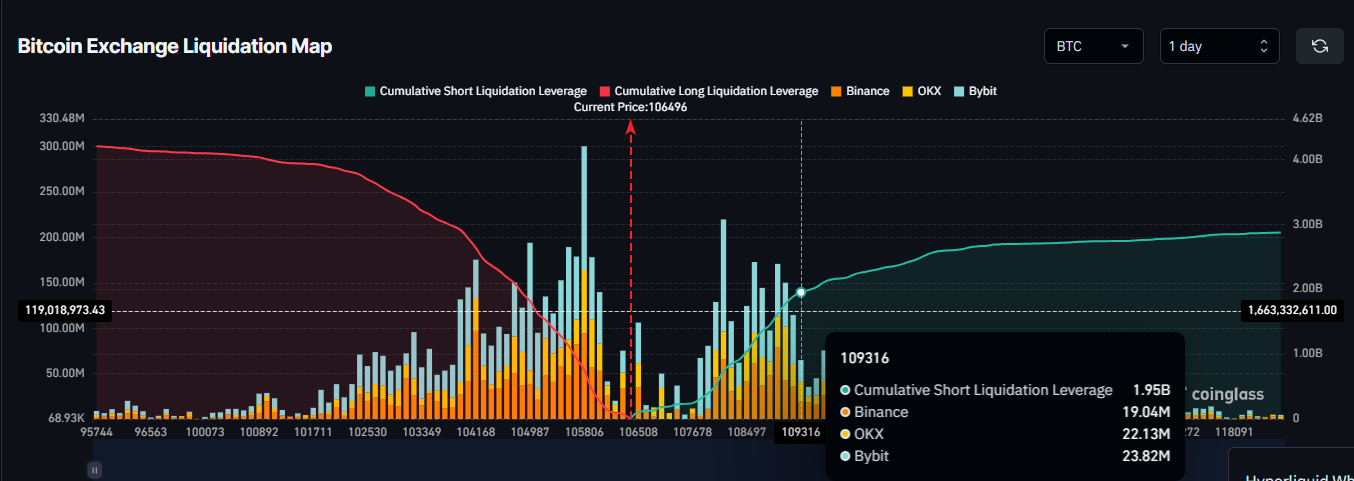

Data from Coinglass shows an uneven liquidation heatmap in the past 24 hours, as bears incurred considerable losses with Bitcoin’s rally. Short positions worth $46.45 million were liquidated compared to $24 million in longs.

Further analysis suggests bears could suffer more liquidation if Bitcoin sustains bullish traction. Coinglass shows that cumulative leveraged positions worth $1.95 billion would be liquidated across exchanges if Bitcoin reclaims its all-time high above $109,300.

Nonetheless, bulls still face massive liquidation risks. If Bitcoin drops to $104,870, leveraged long positions would suffer losses exceeding $1.94 billion.

More Upsides?

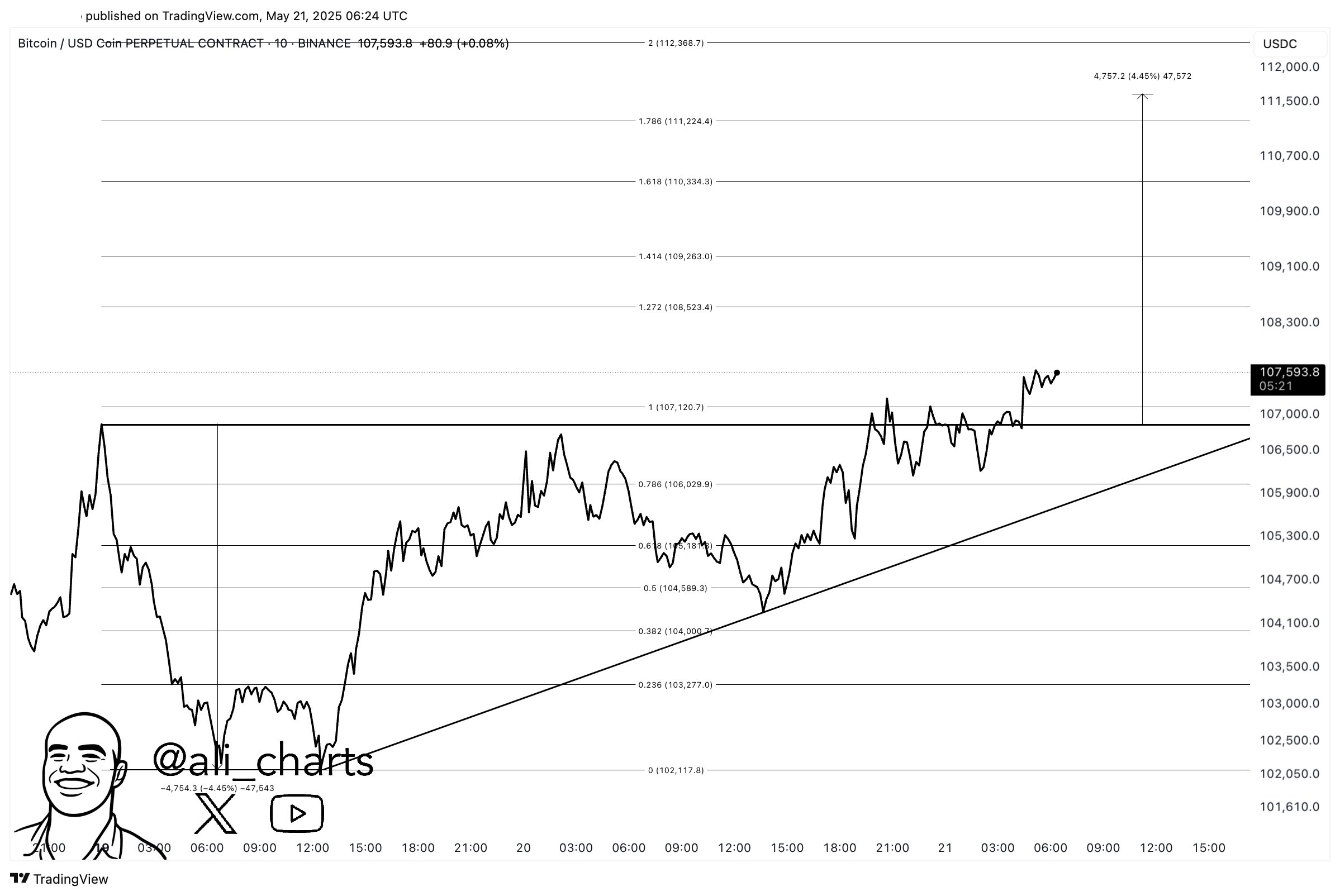

Meanwhile, analyst Ali Martinez has identified the possibility of a sustained upward trajectory for Bitcoin. In a May 21 post, he highlighted that the flagship cryptocurrency may reach a new all-time high of $112,000, citing a potential breakout.

His analysis shows that Bitcoin has broken out from an ascending triangle on the lower timeframes, suggesting a bullish continuation. Martinez analyzed the possible target by the triangle’s length, identifying a possible near 5% rally to above $111,500.

At the time of writing, Bitcoin has retraced slightly from its earlier daily highs, trading at $106,532.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.