Analyst suggests Bitcoin may consolidate before breaking key resistance, setting up for a potential new all-time high.

This prediction comes at a time when the price of Bitcoin (BTC) is currently $108,094, reflecting a -2.09% price decline in the past 24 hours but a 1.31% increase over the last 7 days.

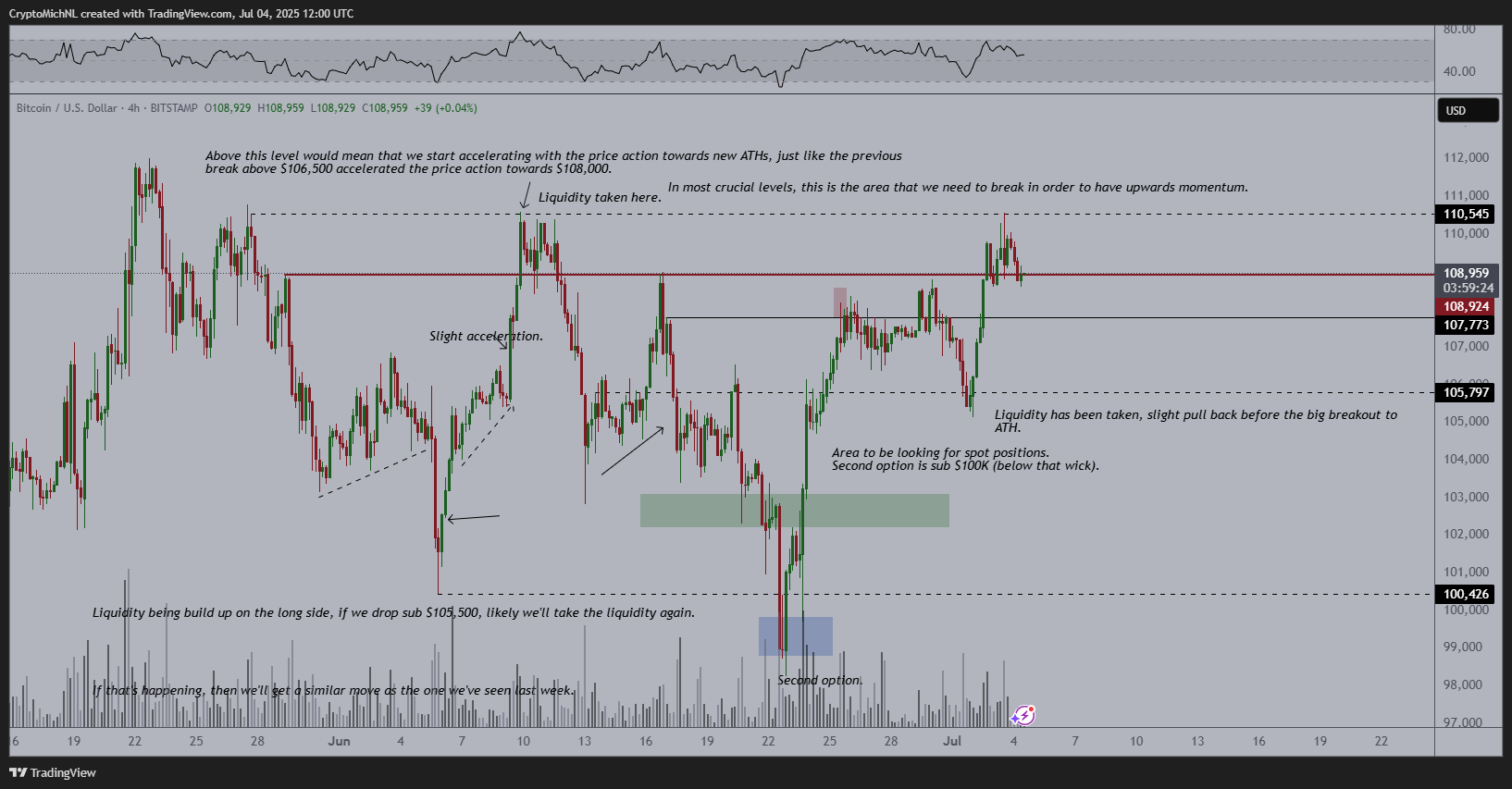

Despite the short-term decline, Michaël van de Poppe, an analyst on X, has shared a chart analysis suggesting a slight pullback is still necessary.

Resistance at $110K: A Key Hurdle

Particularly, Bitcoin is facing significant resistance at the $110,000 level, which has been a major hurdle for the price. Despite multiple attempts to break above this resistance, recent price movements have resulted in rejections, and the price has consolidated just below this zone.

This level first limited Bitcoin’s price on May 27, following its previous all-time high of $111,800, and reappeared as resistance on June 9 and July 3.

However, the analyst views this phase of price consolidation as a crucial preparation for a potential breakout. The market appears hesitant but is gathering momentum for the next move. According to van de Poppe, if Bitcoin breaks above the $110K resistance, fun will come in, as it is the key trigger for Bitcoin to accelerate towards new ATHs.

Liquidity Zones Driving Price Action

Meanwhile, liquidity zones play an essential role in Bitcoin’s movement. The analysis notes that liquidity has been absorbed around $105,797, before rebounding to the current level.

The presence of these liquidity zones may contribute to Bitcoin’s next significant move once the $110K resistance is broken.

Key Price Levels and Targets

Also, the chart identifies important levels to watch, such as $102,900, which could be a key area for potential spot positions. A second target zone is between $99,000 and $100,000, where liquidity may be absorbed before Bitcoin pushes higher.

If Bitcoin’s price drops below $105,500, it could trigger a retest of the liquidity, leading to a potential upward move, much like the price action seen last week. At the time, the price fell below $99,000 on June 22, then recovered to trade above $108,000 by June 26. In that scenario, the price would absorb liquidity and potentially move upward.

Bitcoin’s Derivatives Market is Cautiously Optimistic

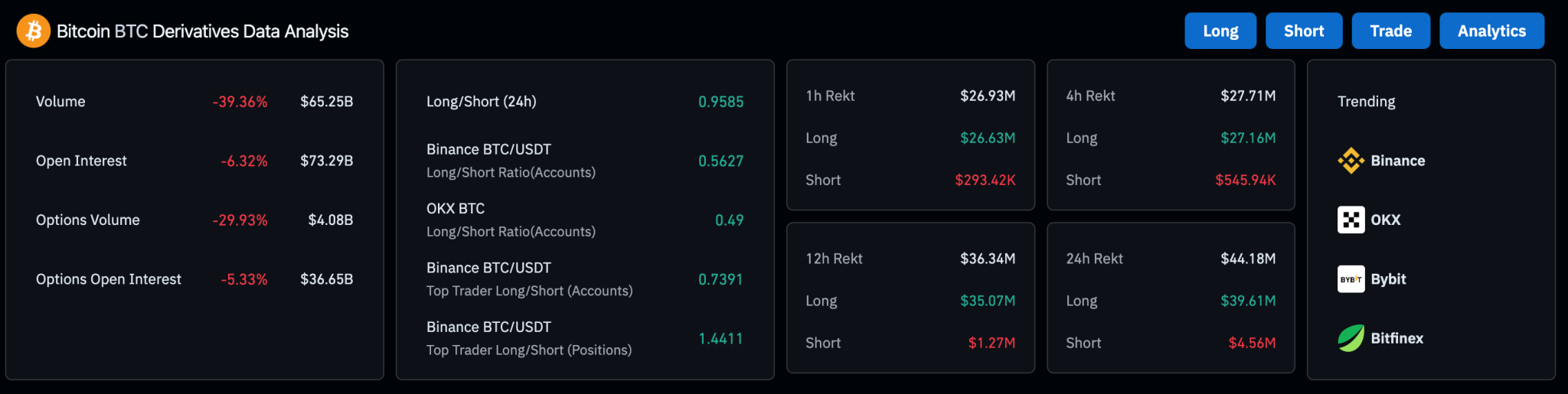

Elsewhere, the Bitcoin derivatives market shows a cautiously optimistic outlook, with a slight pullback in volume (-39.36%) and open interest (-6.32%). This could signal a stabilization phase after recent market activity. The Long/Short ratio of 0.9585 suggests a slightly bearish tilt, with more traders holding short positions, particularly on platforms like Binance (0.5627) and OKX (0.49).

Additionally, the higher liquidations of short positions (1-hour Rekt at $26.93 million, 4-hour Rekt at $27.71 million) suggest upward pressure on prices as short traders are squeezed.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.