Bitcoin has officially validated a multi-year bullish megaphone breakout, with prices now stabilizing above $117,000. The move follows a successful retest of a key trendline that had acted as resistance since 2021.

This technical confirmation, paired with rising open interest and growing institutional inflows, suggests the current rally may not be over. Analysts now view $200,000 as a possible mid-term target if macro and structural indicators continue to align.

Multi-Year Megaphone Breakout Confirmed

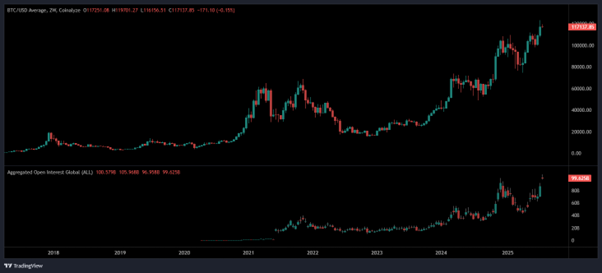

According to analyst Mister Crypto, Bitcoin’s long-term chart displays a classic bullish megaphone structure, spanning from 2019 to 2025. This formation, also known as a broadening wedge, is characterized by rising volatility through higher highs and lower lows.

Bitcoin respected this pattern for years, with multiple touches on both trendlines confirming its validity. A breakout above the upper boundary occurred in early 2025, marking a significant shift in the asset’s macro trajectory.

Following the breakout, a textbook retest of the upper trendline occurred. The price momentarily dipped before reclaiming the $100,000 zone, turning prior resistance into confirmed support.

This kind of structural retest is viewed as crucial in technical analysis, as it reduces the chances of a false breakout. Bitcoin now trades around $117,000, forming new higher highs. The sustained movement post-retest indicates renewed strength in the ongoing bullish cycle, with momentum reinforced by increased demand.

Open Interest and Macro Structure Support Upside

A separate 2-week BTC/USD chart paired with global open interest data shows that a healthy rise in leveraged positions accompanies the ongoing rally. Between 2019 and 2020, Bitcoin remained in a range below $14,000.

A breakout in late 2020 sparked a rally to $65,000 in 2021, followed by a correction down to $29,000. This initiated a lower high–lower low phase, extending through 2022.

The shift began in early 2023, with Bitcoin forming consistently higher lows and regaining strength. The $48,000–$50,000 resistance area, previously rejected in 2022, was broken in 2024. The breakout was followed by a bullish retest around $60,000–$65,000, which held. Bitcoin then surged beyond $100,000.

Open interest has now climbed to $99.62 billion, near its previous peak. Historically, peaks in OI have preceded corrections, but this rise appears gradual and organic, suggesting more room for upside.

The alignment of price action with steadily rising open interest reflects broader participation from market players. If this trajectory continues without aggressive liquidation spikes, Bitcoin could target the $140,000–$160,000 range in the next few months.

Short-Term Targets and Range Structure

On the lower timeframe, analyst Personel Trader outlined a projected three-phase structure for Bitcoin using the 2-hour chart. Price currently sits near $118,947 and is expected to rise toward $125,500, aligning with the 1.272 Fibonacci extension.

The short-term structure includes several intraday pullbacks and consolidations, signaling gradual movement rather than an impulsive breakout.

After hitting $125,500, the projection anticipates a correction toward the $113,000–$114,000 region. This zone aligns with the 0.618 retracement level and a prior demand area. The analyst then expects a final bullish wave that could extend toward $140,000.

This mid-range consolidation, expected to last several weeks, offers scalping opportunities around clearly defined zones.

Together, the long-term breakout, confirmation of trendline support, rising open interest, and short-term range setup form a consistent bullish picture. All key structures remain intact, and Bitcoin continues to trade in an environment conducive to further upside.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.