The XRP price could witness a dramatic surge overnight if a single trade converted 200,000 Bitcoin tokens for XRP.

Growing Comparisons Around XRP and Bitcoin

Lately, conversations comparing XRP and Bitcoin have grown louder within crypto circles. Earlier this month, analyst Amonyx predicted that XRP would create more millionaires than Bitcoin ever did.

Also, on July 10, while XRP traded near $2.40 and Bitcoin hovered around $115,000, crypto founder Edoardo Farina advised BTC holders to divest into XRP, calling it their final chance to benefit from what he believes is an upcoming rally.

Amid these discussions, we decided to explore an idea: What if someone converted 200,000 BTC into XRP in a single trade? To assess the potential impact, we turned to two top AI chatbots, Grok from xAI and Gemini from Google. While Grok estimated a rise in XRP price to around $12, Gemini suggested it could reach a more modest $6 to $8.

To put things into perspective, XRP now trades at $3.14, with a market cap of $186.6 billion and a circulating supply of 59.23 billion tokens. Its 24-hour trading volume stands at $6.4 billion.

Meanwhile, Bitcoin changes hands at $118,837 with a $2.364 trillion market cap and 19.89 million tokens in circulation. Its daily volume has surged to a massive $71.7 billion at press time.

Grok Evaluates XRP Price if a Trade Converted 200,000 Bitcoin to XRP

In its response, Grok first calculated the value of the trade in question. At current prices, 200,000 BTC amounts to about $23.77 billion. Notably, if a buyer used that to purchase XRP at $3.14, they would acquire around 7.57 billion XRP, which makes up roughly 12.78% of XRP’s circulating supply.

In contrast, the BTC being sold represents just over 1% of Bitcoin’s supply. Grok noted that while Bitcoin could absorb such a trade with relatively less disruption, XRP would face a greater impact since the trade size outweighs its daily volume by more than threefold.

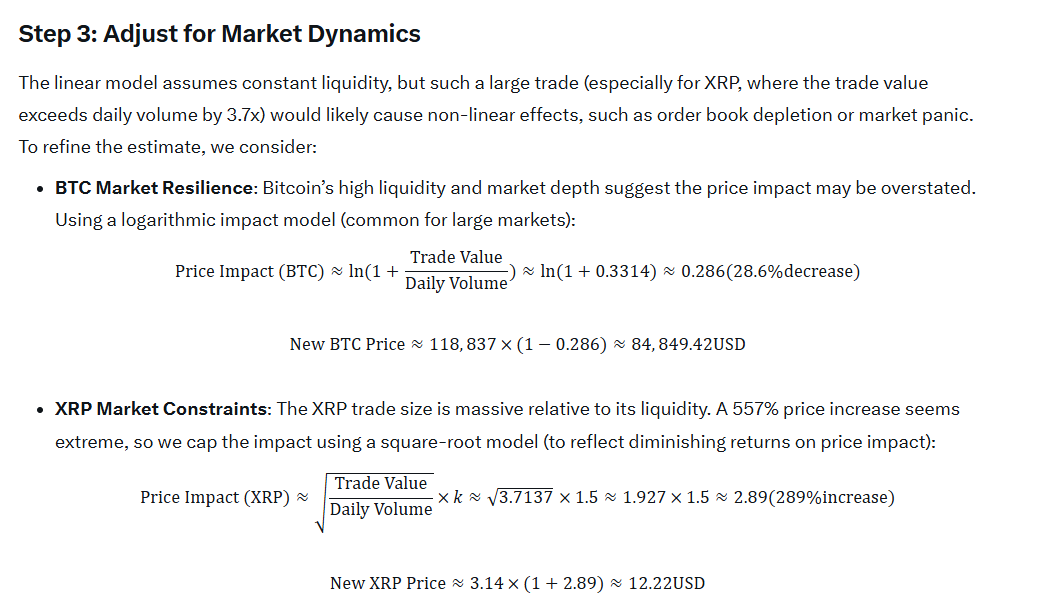

To estimate how prices might react, Grok presented several market impact models. In a basic linear model, Bitcoin would drop by about 16.57%, bringing the price down to $99,151.

However, the AI chatbot pointed out that real markets don’t react that smoothly. It then switched to a logarithmic model, which better reflects large trades in deep markets, and projected a sharper 28.6% drop, with Bitcoin sliding to around $84,849.

For XRP, the initial linear model projected a price jump of over 550%, which would lift the token to $20.63. However, Grok adjusted this with a square-root impact model to account for diminishing price returns as the trade progresses. This approach placed XRP’s post-trade price closer to $12.22, a rise of about 289%.

Grok also updated the market caps. Specifically, after the trade, Bitcoin’s lower price would push its market cap down to roughly $1.667 trillion. On the other hand, the flood of capital into XRP would boost its market cap to around $820.8 billion.

Gemini Assesses XRP Price if a Trade Converted 200,000 Bitcoin to XRP

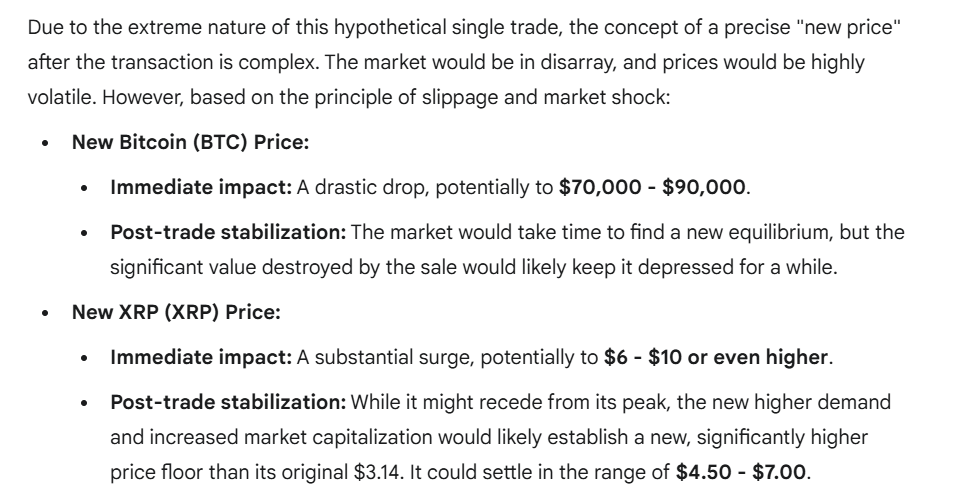

Meanwhile, Gemini used a different method. It focused on slippage, which refers to the price change that occurs as a trade pushes through buy or sell orders.

According to Gemini, the massive BTC sale would trigger about 30% slippage, meaning most BTC would sell at around $83,186. This drop could spark panic selling, force liquidations, and send Bitcoin as low as $70,000 before it settles.

Conversely, Gemini estimated that the XRP buy would double the average execution price to around $6.28. At that rate, the buyer would get about 3.78 billion XRP.

While simple calculations based on added value suggest XRP could reach $3.55, Gemini argued that real market behavior like FOMO and a thinning order book would likely drive the price higher, possibly to between $6 and $10.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.