A top market analyst has identified the level XRP must breach to soar to “Valhalla” as well as the region that could trigger the next bear market.

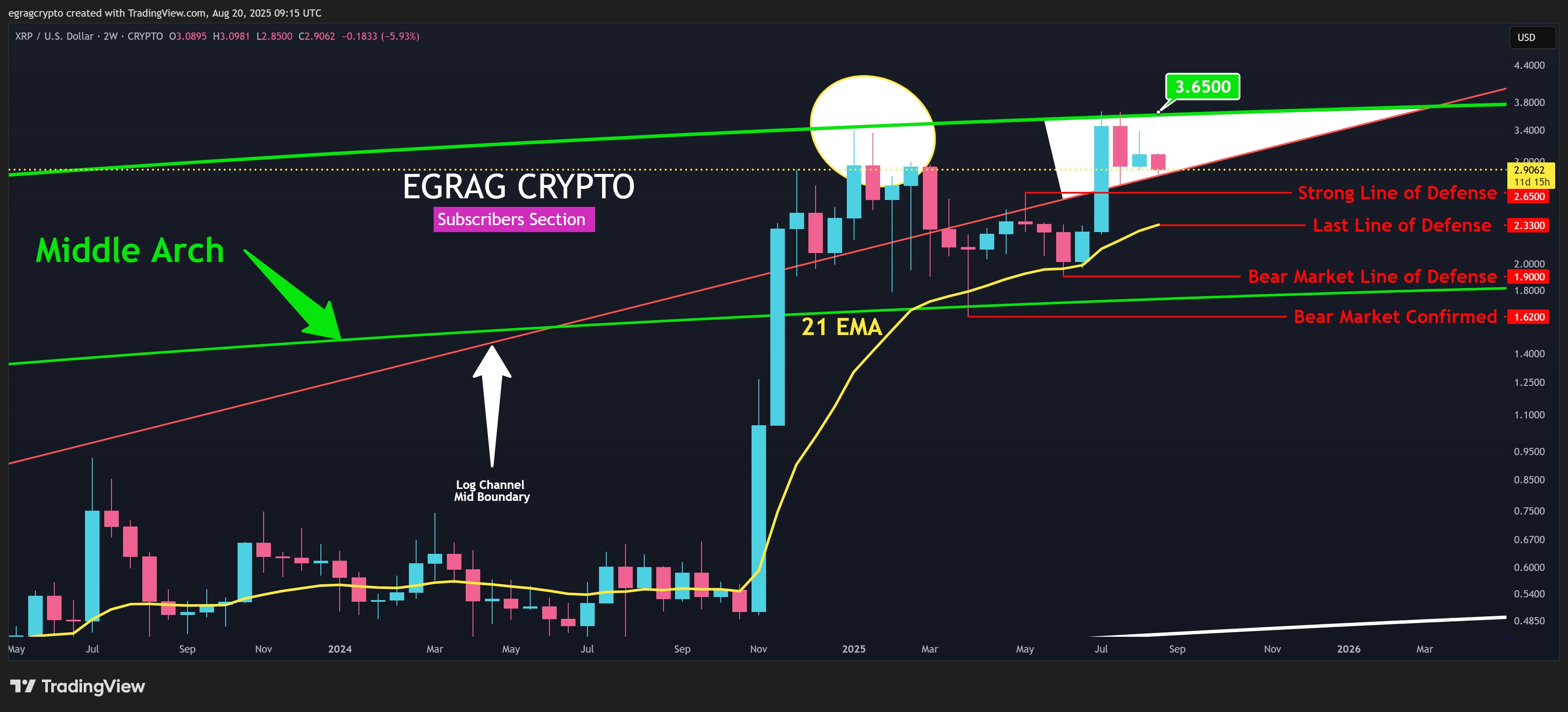

EGRAG Crypto recently discussed these levels as XRP battles the bears at $3. Notably, his analysis uses a logarithmic regression model and a formation he calls the “Bent Fork,” which shows both the upside potential and the danger zones for XRP.

Importantly, his chart features a regression channel drawn on a logarithmic scale. This model highlights previous cycles and how XRP moved in parabolic waves during these cycles.

XRP Needs to Close Above $3.65 to Aim for Valhalla

According to his charts, XRP now sits in its third major cycle and is pressing against the mid-point of the channel. Further, the Bent Fork identifies arches and boundaries on this structure, showing where momentum could either break free or collapse.

Specifically, EGRAG pointed to the July 18 high at $3.65 as the major breakout trigger. He noted that if XRP can close above this level, the market will push into price discovery and set up a run toward a region he calls “Valhalla,” which aligns with the $23 price mark.

Interestingly, this target matches the upper boundary of the Bent Fork, which has provided a guide for his cycle analysis. Similar breakouts in earlier cycles produced massive gains that culminated in a rally to the upper boundary, and EGRAG believes this one could follow the same path.

Particularly, when XRP soared in Cycle 1, it reached the upper arch of the Bent Fork at an all-time high of $0.0614 in December 2013. A similar run during Cycle 2 saw XRP hit the upper arch at $3.3 in January 2018. Now, in Cycle 3, the upper arch sits at $23, and EGRAG expects a similar run.

A Drop to $1.62 Would Mark the Start of a Bear Market

However, the bullish case depends on XRP holding important support levels. The first level sits at $2.90, which marks the middle of the regression channel. As long as the price stays above this zone, the bullish structure remains intact.

EGRAG noted that if XRP slips below it, the next strong defense appears at $2.65. A quick dip under that level may not matter, but closing the day below it would weaken the setup. This aligns with his previous suggestion that it is all noise until XRP breaks above $3.65 or dips below $2.65.

Meanwhile, another important marker sits at $2.33, which aligns with the 21-week exponential moving average. EGRAG describes this level as the final lifeline for the bullish structure. A fall through $2.33 would make it much harder for XRP to reclaim its former all-time high, let alone aim for the higher arches of the Bent Fork.

If the slide continues, $1.90 becomes the line where bearish momentum begins. Dropping through that level would flip the market tone from hopeful to defensive.

Meanwhile, the danger zone would deepen at $1.62, which EGRAG marks as confirmation of a full bear market. A close below that point, especially under the mid-arch of his model, would indicate the start of a downward cycle.

Right now, XRP trades for $2.92, still holding the primary support at $2.9. Notably, the larger cycle structure leaves room for upside as long as XRP maintains its ground above this region or the lower support levels.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.