Ethereum Surges in Correlation to SP500, Also ETH Balances on Exchanges Hit Lowest Level Since 2018.

Ethereum remains tightly correlated to the SP500, a situation that has proven to be beneficial for the second-largest cryptocurrency, especially following the FOMC announcement 3 weeks ago.

The FOMC announced an interest rate hike, with a number of other planned hikes for the year as a strategy to curb the rising inflation which has reached its highest level in 40 years.

Following the announcement, U.S stocks have experienced a rally which Ethereum also benefited from as it is correlated to the SP500, one of U.S’ top stock indexes.

The crypto market has in the past been correlated with the stock market, a phenomenon that made the market quite predictable with Bitcoin leading the way. However, things have turned around with Ethereum now being the only asset correlated with the SP500 and the outcome has been good so far.

? #Ethereum, not #Bitcoin, is the top asset staying tightly correlated to the #SP500's performance. And since the #FOMC announcement 3 weeks ago, this has been good news for $ETH. Watch if #fed news causes any downswings for the May #FOMC update. https://t.co/VHXMQAKhUZ pic.twitter.com/VsFdCHqsFi

— Santiment (@santimentfeed) April 4, 2022

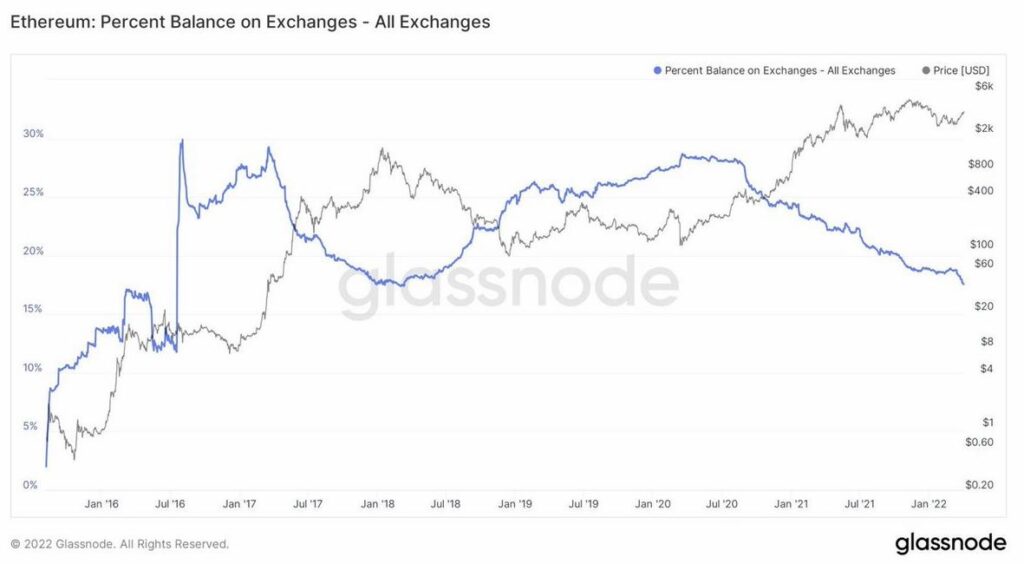

Ethereum balances on exchanges hit the lowest level since 2018

As Ethereum continues to enjoy price growth as a result of the SP500 correlation, the Ethereum balance available on exchanges has also dropped, reaching the lowest level since July 2018. It is a significant development as low asset levels on exchanges suggest a bullish sentiment from investors.

Essentially, it means investors take their ETH from exchanges and save them in private wallets to hold for a long time rather than sell it. This is a bullish case for Ethereum as investors are expecting a price rise in the future as long as the U.S stock market continues to rally.

Uncertainty looms with the May FOMC update

Will Ethereum continue to rally in the coming months? That will depend on the May FOMC update. According to the Fed calendar, another FOMC update is due in May, which will either result in a sustained rally for the stock market or a downswing. This will in turn affect Ethereum unless there is decoupling from the SP500.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.