Addresses with Less than 1 BTC have Increased over 5% Since January as Retail Accumulate BTC.

Bitcoin has dropped significantly since January 2022, going as low as $34,000 before the current relief rally. Data from crypto analytics platform IntoTheBlock shows that retail investors have been accumulating BTC during this time.

Specifically, the number of addresses holding less than 1 BTC has increased by 5.5% since the January lows. This is an indication that along with institutions that are the major holders of the asset, retail investors are acquiring more as the sentiment remains bullish.

Also in the last 30 days, addresses holding between 0.1 and 1 BTC have increased their balances by 1.47%.

Retail is accumulating $BTC

Addresses holding 0.1-1 BTC have increased their balance by 1.47% in just 30 days.

Moreover, since the January lows, all the clusters of addresses holding below 1 BTC have increased their holdings up to 5.51%.https://t.co/kGlQpvSj57 pic.twitter.com/qHBoyAmxWj

— IntoTheBlock (@intotheblock) April 5, 2022

BTC exchange balance at its lowest in over 3 years

There has been a massive outflow of BTC from exchanges to personal wallets. This has brought the BTC balances on exchanges to the lowest in a long time. The last time such levels were recorded was over 3.5 years ago, meaning there is a strong positivity around the asset.

The last time the #Bitcoin balance on Exchanges was this low was 1,311 days ago (or over 3 1/2 years ago). pic.twitter.com/q2fNiOhNtd

— On-Chain College (@OnChainCollege) April 4, 2022

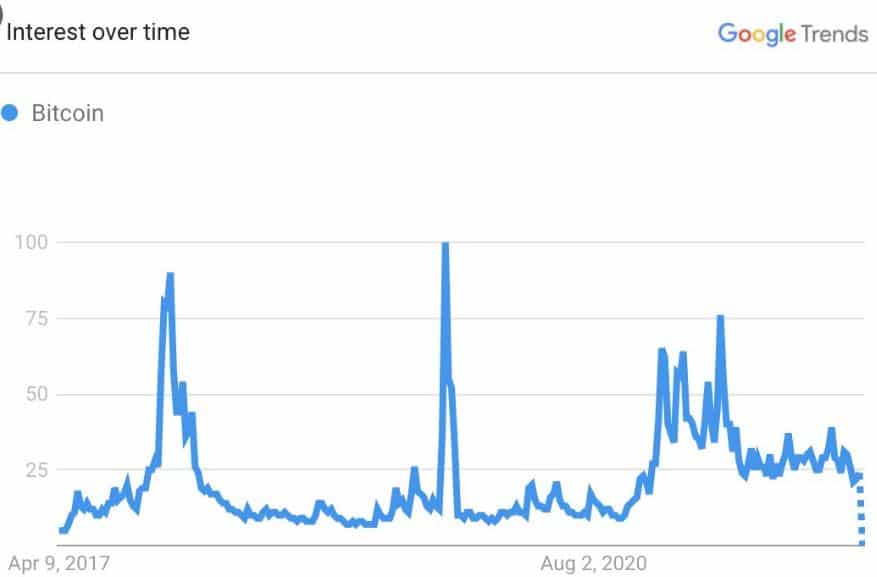

This may have contributed to the recent rally that Bitcoin experienced which took the price to as high as $47,000. This is in spite of the fact that Google searches for Bitcoin are dropping to bear market lows. The price has so far held above $45,000 which was a major resistance and may go further if it breaks above $50,000 and stays above it.

What this means for Bitcoin

It is usually a good thing for retail or institutional investors to accumulate Bitcoin, which eventually leads to price gains. This is the likely outcome as investor confidence continues to build up, and the drop in the asset’s price since January may soon be over if this bullish trend is sustained. The Mid-halving event is coming in a few days and it will be interesting to see how things playout for the largest cryptocurrency.

Bitcoin Mid-halving Event

Bitcoin Due for Mid-halving Event Next Week. What should you Expect?

BTC Google Searches:

Google searches for Bitcoin dropping to bear-market lows, yet the price is cruising at $46K and heading higher, which is a good sign.

MicroStrategy Bitcoin Buring:

MicroStrategy purchased 4,167 BTC for $190.5m at an average price of $45,714. MicroStrategy holds 129,218 BTC acquired for $3.97b at an average price of $30,700. Previously, MicroStrategy, a subsidiary of MicroStrategy, announced a $205m bitcoin-backed loan with Silvergate Bank.

MacroStrategy has purchased an additional 4,167 bitcoins for ~$190.5 million at an average price of ~$45,714 per #bitcoin. As of 4/4/22 MicroStrategy #hodls ~129,218 bitcoins acquired for ~$3.97 billion at an average price of ~$30,700 per bitcoin. $MSTRhttps://t.co/Z45OuJU5KI

— Michael Saylor⚡️ (@saylor) April 5, 2022

At the price of $46,686 Bitcoin Greed and fear indicator is still neutral but Microstrategy Bitcoin buying may boost investor trust to buy more BTC at current prices.

Bitcoin Fear and Greed Index is 53 ~ Neutral

Current price: $46,686 pic.twitter.com/Qr09of1DjO— Bitcoin Fear and Greed Index (@BitcoinFear) April 5, 2022

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.