Analysis of Terra Classic Data Sheds Deeper Insight on Effects of 1.2% Burn Tax on LUNC Volume.

A LUNC proponent and software developer has shared deeper insight on the effects of the introduced 1.2% tax burn on Terra Classic (LUNC) volume.

The Terra community had shown renewed interest in the 1.2% tax burn proposal as the campaign for the revival of Terra Classic (LUNC) gained steam. The community solicited support from several exchanges, and their fervency was rewarded with cooperation from top exchanges, including the world’s largest, Binance.

Notwithstanding, the community has noticed that LUNC volumes appear to suffer due to the 1.2% tax burn mechanism. This has been prompted by reluctance from investors to subject their assets to burns, contributing to a dearth of interest in the asset.

Despite these speculations, a proper in-depth analysis of the effects of the tax burn mechanism on LUNC volumes has not surfaced until now. Software developer and LUNC proponent StrathCole recently indulged the community in that regard.

In an analysis on Medium, StrathCole assessed LUNC volumes in four periods, including before and during the implementation of the 1.2% tax burn mechanism. He moved to exclude data from certain periods, as trade volumes than were affected by other factors besides what is considered normal.

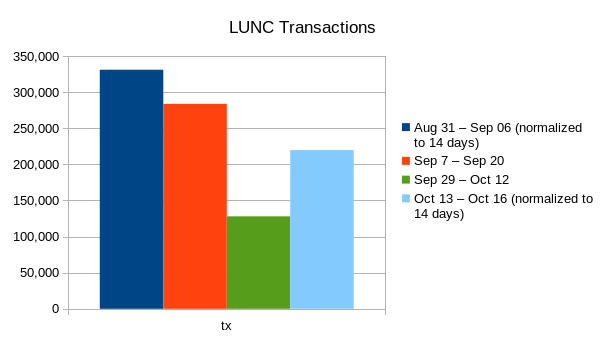

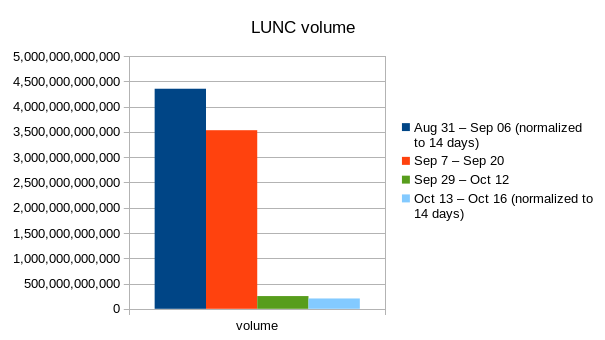

The first period was between September 7 and 20; the second period, between September 29 to October 12; the third period which ranged from August 31 through September 6 was introduced to validate the first period; the fourth period was between October 13 and 16.

Data from the third period (August 31 to September 6) revealed LUNC volumes that surpassed 4 trillion LUNC, making way to the 4.4 trillion LUNC territory. However, the first period (September 7 to 20) saw a 20% decline from the fourth, as volumes dropped to a cap of 3.5 trillion LUNC.

The second period (September 29 to October 12) witnessed the most massive decline in LUNC volume, with data revealing a volume collapse below the 500 billion mark, as the volume decreased by over 90%. The fourth and final period (October 13 to 16) was still declining from the second, as volume hit below 250 billion LUNC.

In addition to the volume, LUNC transactions also saw massive declines during this time, but not as much as the volume. Although there was a slight recovery at first, the volume still suffered regardless. StrathCole asserted that the transaction count did not decline as much as the volume due to the average transaction size.

It bears mentioning that this analysis excluded data from notable Binance transactions pre-tax that would’ve contributed to higher volume data if included in the analysis.

As a conclusion of his analysis, StrathCole highlighted that the tax burn mechanism has really contributed to a dearth of investor interest in LUNC. “In addition, the tax hurts those the most that bring the most value to the chain (contracts/dApps and their users). That is not how it should be, I think,” he added.

Recall that the community noticed this drop in LUNC volume, which sparked several debates. As a consequence, the community passed a new proposal to reduce the 1.2% tax burn to 0.2% as a way to reintroduce interest in the asset, as recently reported by The Crypto Basic.

StrathCole mentioned that his analysis cannot accurately assess the effect of the reduction of the tax burn to 0.2%, as there isn’t much data on that proposal yet. However, he noted that he doesn’t expect an immediate recovery in LUNC volume following its implementation.

“This is mainly because of the fact that CEXs will not necessarily change their current way of handling their on-chain wallets. But I think it is the right step to do now,” StrathCole concluded.

He further mentioned that he understands the point of view of the proponents who believe it is too early to reduce the tax burn rate. Notwithstanding, he added that he doesn’t envision any improvement in the LUNC volume data, as transactions are still s

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.