Michael Saylor’s MicroStrategy has increased its BTC exposure, bringing the company’s total holdings to 0.754% of Bitcoin’s total supply.

U.S.-based software company MicroStrategy revealed in a Monday filing with the United States Securities and Exchange Commission (SEC) that it has purchased an additional 5,445 BTC (approximately $147.3 million).

The latest purchase brings the company’s Bitcoin portfolio 158,245 BTC (roughly $4.1 billion), strengthening its position as the largest corporate Bitcoin holder.

However, the company’s BTC holding is still posting $500 million in unrealized losses, given Bitcoin’s current market price of around $26,080. MicroStrategy acquired its total 158,245 BTC at an average of $29,582 per BTC (approximately $4.6 billion).

MicroStrategy has acquired an additional 5,445 BTC for ~$147.3 million at an average price of $27,053 per #bitcoin. As of 9/24/23 @MicroStrategy hodls 158,245 $BTC acquired for ~$4.68 billion at an average price of $29,582 per bitcoin. $MSTR https://t.co/GbJtUoQfXv

— Michael Saylor⚡️ (@saylor) September 25, 2023

MicroStrategy Now Owns 0.75% of Bitcoin Supply

Since incorporating Bitcoin alongside its corporate strategy, MicroStrategy has only grown with its exposure to the leading crypto asset. The latest purchase means the company owns an estimated 0.754% of Bitcoin’s 21 million coin supply.

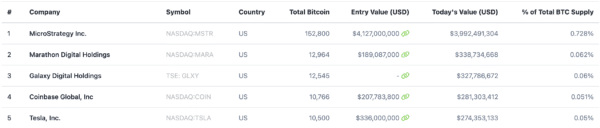

Data from Coingecko also shows that MicroStrategy is far ahead of any public company with Bitcoin on their balance sheet. Bitcoin miner Marathon is MicroStrategy’s closest rival, with 12,964 BTC (approximately. $338 million) in its purse, with Galaxy Digital, Coinbase, and Tesla rounding off a list of the top five public U.S. companies holding BTC.

MicroStrategy Remains Bullish on BTC

Since coming onto the scene in August 2020, MicroStrategy and its chairman, Michael Saylor, have been resolute in their decision to make Bitcoin a core component of their business operations.

Despite critics claiming the strategy would drive MicroStrategy out of business, the company has only stacked more bitcoins amid a broader crypto market downturn.

Michael Saylor has publicly expressed a conviction that countries, banks, and conventional finance would eventually want exposure to BTC as the asset class matures.

The MicroStrategy executive has also spearheaded a crusade to drive corporate Bitcoin adoption, even stepping down as the company’s CEO to focus on the mission.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.