The latest XRP Ledger (XRPL) quarterly report from Messari suggests that the XRP ecosystem ended Q3 2023 on solid ground, with XRP’s market cap up 60% YTD while XRPL’s DEX volume surged 390% QoQ.

The report confirmed that the landmark victory in the Ripple vs. SEC lawsuit catalyzed XRP’s incredible performance in the past quarter. Recall that Judge Analisa Torres, in her July 13 verdict, ruled that XRP in itself is not a security, contrary to the SEC’s initial claims.

Following the landmark verdict confirming that XRP is not a security, XRP ended Q3 with its market cap up almost 60% YTD. XRPL's DEX volume also increased nearly 400% QoQ.

XRPL aims to end the year strong, with new developments including Hooks and AMM & Clawback amendments. pic.twitter.com/EWGTQLw2SO

— Messari (@MessariCrypto) October 27, 2023

XRP Recorded Impressive Values in Q3

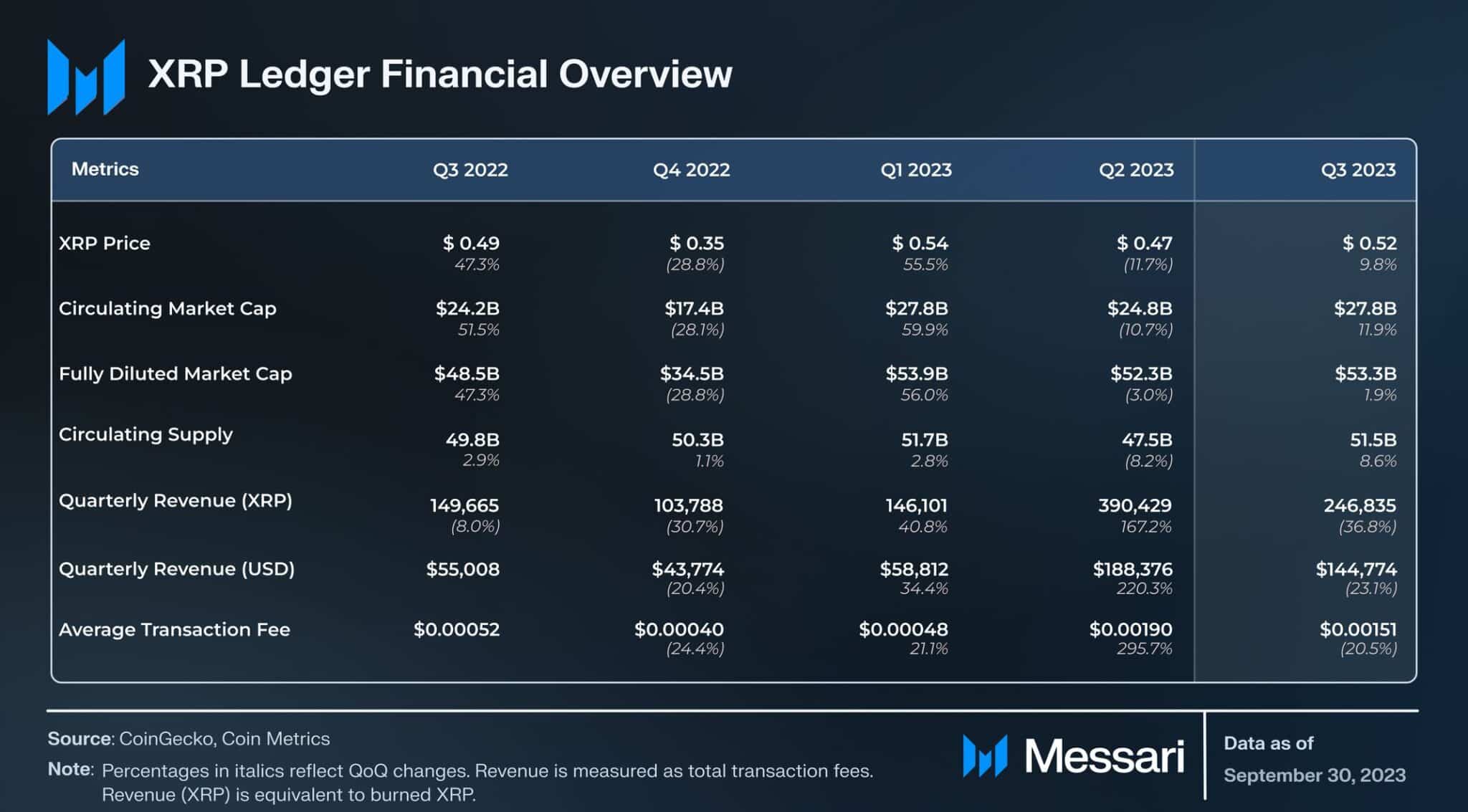

In response, XRP rallied 99% to a yearly high of $0.9380 within 24 hours. Despite facing opposition and relinquishing some of these gains, the Messari report confirms that XRP ended Q3 with a bullish footing, having closed the quarter at a price of $0.52, representing a 9.8% increase quarter-on-quarter (QoQ).

In addition, the $0.52 close to Q3 2023 translates to an impressive 57.5% increase in XRP’s price year-to-date (YTD). Meanwhile, XRP’s market cap witnessed a more substantial increase within this timeframe, according to the report. This was due to Ripple’s monthly escrow unlocks.

The Messari report reveals that XRP’s market cap surged from $24.8 billion in Q2 to $27.8 billion in Q3, marking an 11.9% increase in QoQ. Moreover, the $27.8 billion value represents a nearly 60% increase YTD.

Interestingly, XRP’s market cap stood at $17.4 billion by the end of 2022. At the time, XRP was the sixth largest crypto asset in the market, below BTC, ETH, USDT, USDC, and BNB. The $27.8 billion close to Q3 suggests that XRP added $10.4 billion to its valuation from Q4 2022 to Q3 2023.

More remarkably, the asset’s market cap has increased further at the time of reporting, currently at $30.6 billion. As a result, XRP is now the fifth largest crypto asset, having overtaken USDC, which has continued to witness declines in its valuation.

XRPL Sees Mixed Metrics in Q3

The bullishness of the third quarter extended to the broader XRP Ledger (XRPL) ecosystem, but the XRPL witnessed mixed metrics. The report also called attention to these records, noting that the native decentralized exchange (DEX) on the XRPL saw a massive 390% rise in volume.

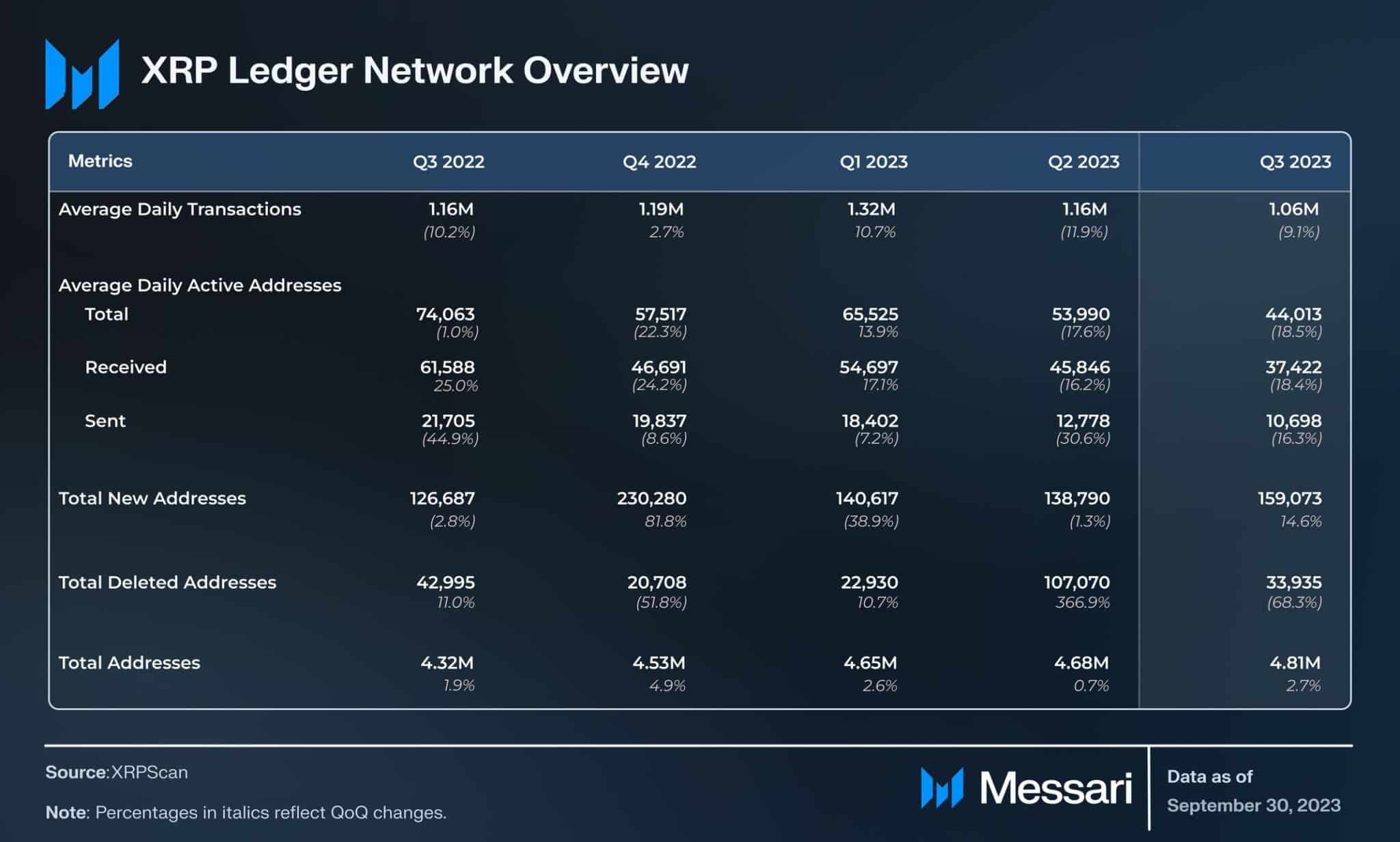

The network also observed a substantial increase in the number of accounts in Q3, seeing an addition of 125,000 accounts. According to Messari, XRPL accounts grew by 2.7% in Q3, hitting a new figure of 4.81 million. In addition, new OTC addresses surged to 159,100, marking a 14.6% increase.

In an alternate trend, the XRPL saw decreased activity in the third quarter, as was the pattern with other blockchain networks. Messari notes that average daily transactions dropped from 1.16 million in Q2 to 1.06 million in Q3, representing a 9.1% decline QoQ. Average daily active addresses also slowed by 18.5% to 44,013.

Messari also called attention to existing and upcoming advancements within the XRPL ecosystem. These advancements include amendments to include a native Automated Market Maker (AMM) and a Clawback feature.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.