Market analysts have identified bullish XRP structures on the daily and monthly price charts, with one of these setups signaling an imminent parabolic rally for XRP.

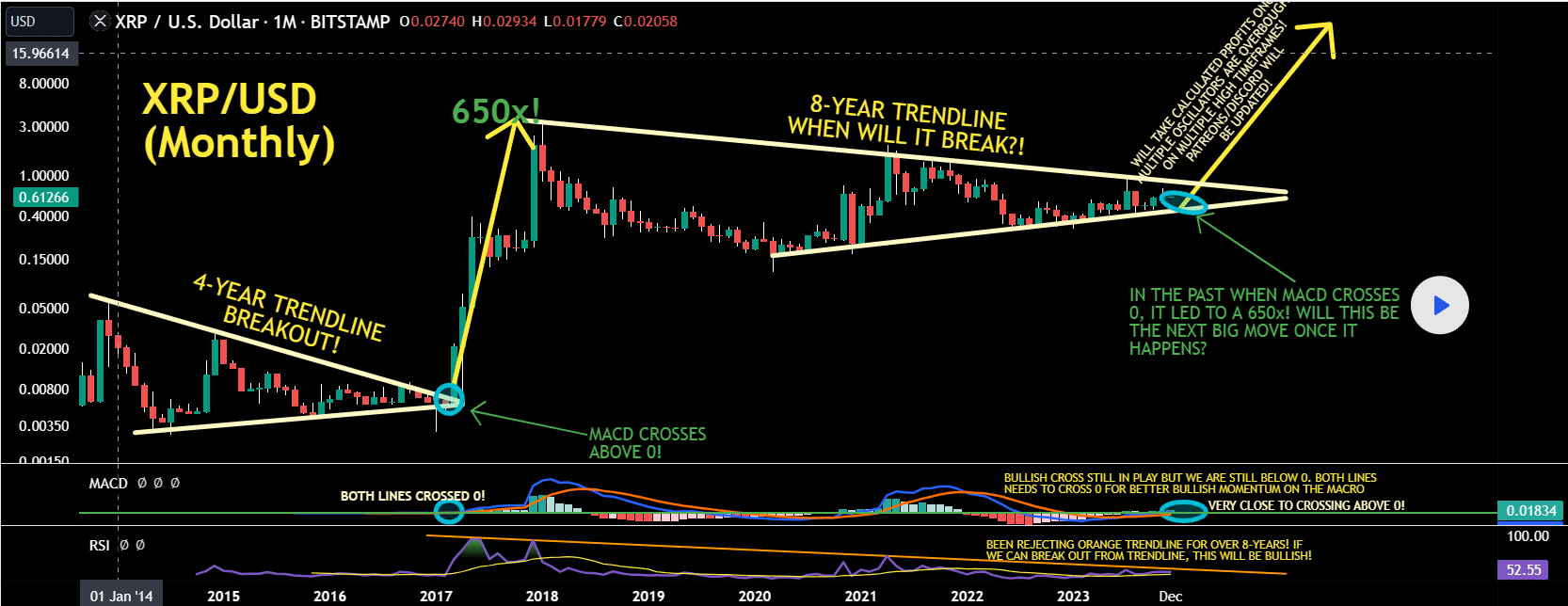

Renowned crypto analyst JD highlighted this structure in his latest XRP analysis. His report considered an XRP monthly chart, in which he pointed out the effects of two phenomena in catalyzing a substantial price upsurge for XRP.

In his analysis, JD called attention to a multi-year downward trendline and the Moving Average Convergence/Divergence (MACD) indicator. According to the analyst, when the MACD crosses above the 0 threshold, it usually signals a looming parabolic surge.

However, XRP would need to break out of a descending trendline for this surge to occur. The combination of these two events has only happened once in XRP’s entire history, from late 2013 to early 2017.

Notably, XRP surged to a high of $0.06144 in December 2013, shortly after its launch. Nonetheless, this rally met opposition from the bears, resulting in seven months of consecutive price declines. Although XRP showed resilience in the following months, it remained in a downtrend.

This downtrend persisted for four years, creating a 4-year downward trendline. XRP eventually broke out of the trendline in March 2017. Interestingly, this breakout coincided with both lines of the MACD indicator crossing above the 0 level. XRP surged 650x after the breakout, JD’s chart says.

XRP Aims for Another Parabolic Run

The 650x rally resulted in the XRP all-time high of $3.31. However, the asset faced another opposition, leading to a second period of declines. Despite showing resilience over the years, XRP remains within the confines of this downtrend. JD’s chart suggests the downtrend has lasted eight years, but data confirms it’s six years.

Amid the general bearishness, JD says the charts present a reason to switch sentiments. He confirmed that the MACD indicator is now close to crossing above 0. However, he noted that both lines of the indicator need to register this bullish cross to confirm the impending run.

Should this occur, XRP could break out of the current 6-year downtrend. According to JD, the combination of these two events would mark the start of another parabolic surge for XRP, similar to the 650x increase. However, he chose not to set a definite price target.

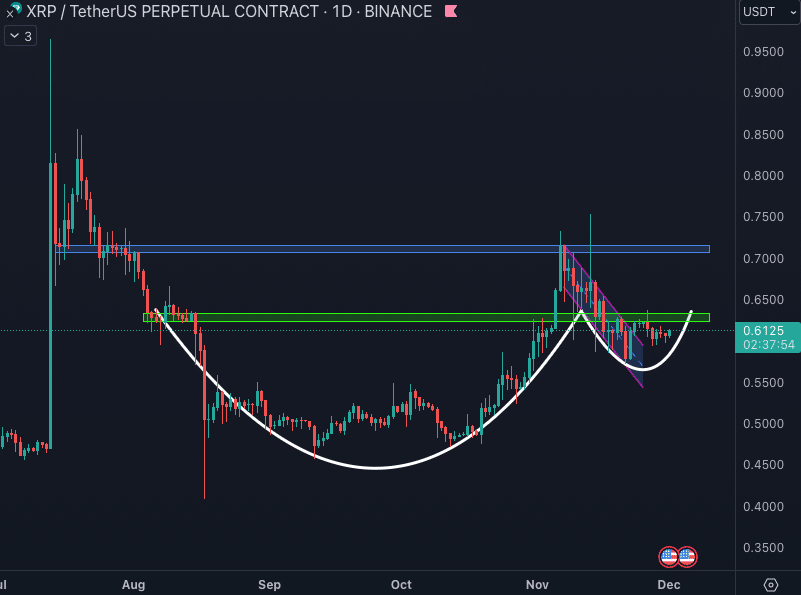

The Cup and Handle Pattern

Meanwhile, in the short term, XRP has battled the bears at the $0.60 price threshold. Amid this battle, the asset has formed a Cup and Handle structure, according to technical analyst Cryptoes. The Cup and Handle pattern usually signals an imminent continuation of a previous uptrend after a period of consolidation.

Cryptoes emphasized that XRP needs to close above the green resistance point currently sitting at the $0.64 price territory. XRP currently trades for $0.6136, up 1.54% over the past 24 hours. However, trade volume has declined 10% to $836,511,976.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.