Uphold maintains support for XRP despite going on a delisting spree affecting multiple popular crypto assets such as Shiba Inu (SHIB), Cardano (ADA), Stellar (XLM) and others in Canada.

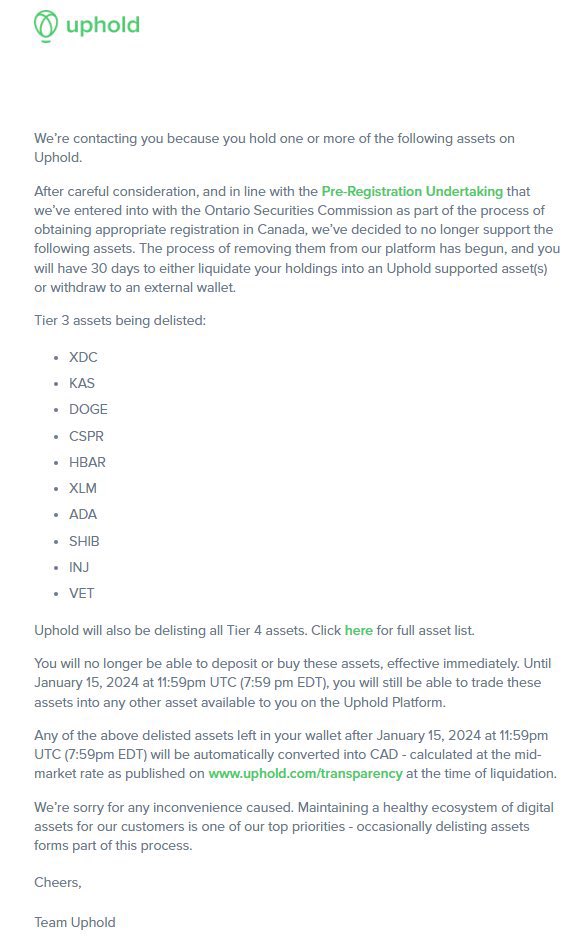

In a recent email to concerned Canadian customers and obtained by The Crypto Basic, Uphold revealed it would be delisting some of the assets in its Tier 3 asset class, and all the assets in its Tier 4 asset class in Canada.

Uphold explained that the delisting of these assets is in adherence to the Pro-Registration Undertaking that it signed with the OSC as it pursues registration in Canada. The OSC oversees the securities market in Ontario, and has recently taken a stricter stance on crypto platforms.

The affected crypto assets in Tier 3 include Cardano, Stellar, Shiba Inu, XDC Network (XDC), Dogecoin (DOGE), Casper Network (CSPR), Hedera (HBAR), Injective (INJ), Kaspa (KAS), and VeChain (VET).

Note that several other crypto tokens such as Bitcoin (BTC), Ethereum (ETH) and Algorand (ALGO) are also Tier 3 assets. However, these cryptocurrencies were not affected by the recent development. Interestingly, XRP is another Tier 3 asset that survived the nuclear action.

In addition to the select Tier 3 tokens, Uphold also revealed plans to delist all assets under the Tier 4 category. Some of the most notable cryptocurrencies in this category are Terra Classic (LUNC), Filecoin (FIL), and newcomer BONK (BONK).

Uphold informed its customers that they have already started the process of removing the affected crypto assets, disclosing that customers have 30 days to either convert the assets to other crypto tokens not affected by the development or withdraw the assets to an external wallet.

According to the disclosure, Uphold has already suspended deposit and purchase functions for the assets. However, customers have until Jan. 15, 2024, to convert to other assets or withdraw. After the deadline, any remaining balance of the affected assets will be automatically converted into Canadian dollars.

Community Reactions

After receiving several questions regarding the rationale behind the recent development, Dr. Martin Hiesboeck, Head of Research at Uphold, emphasized that the move was aimed at maintaining compliance with the regulatory requirements in Canada. “We have to adhere to new rules up north,” he said.

However, pro-crypto lawyer Bill Morgan was not satisfied with this reasoning. Morgan questioned why the “new rules up north” do not mandate the removal of Ethereum.

He affirmed that he is not actively pushing for Ethereum to be delisted, but asked what makes the asset different from the others the exchange aims to delist.

It seems the rules up north don’t require Ethereum to be removed from your platform. Don’t get me wrong I wouldn’t want that to happen but why is Ethereum OK to list but not these ones ?. What is the legal basis for the distinction? I doubt there a basis for the distinction in… https://t.co/r6xSCnWuEC pic.twitter.com/fjzI0LnucI

— bill morgan (@Belisarius2020) December 17, 2023

“What is the legal basis for the distinction? I doubt there a basis for the distinction in Canadian law anymore than there is one in US law,” Morgan remarked.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.