A prominent market veteran has identified a key Bitcoin (BTC) support level that is pivotal in the asset’s defense against a collapse to the $60,600 price territory.

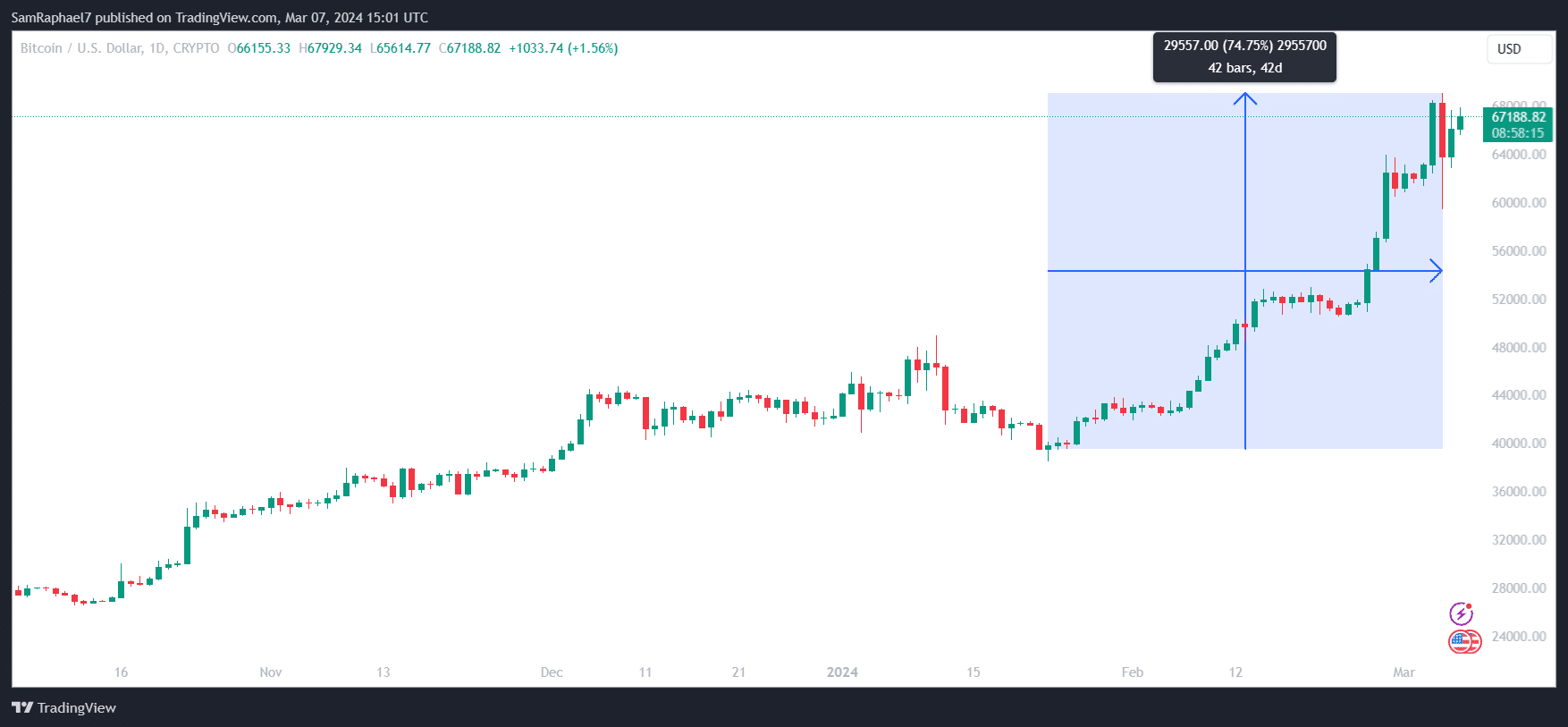

Bitcoin has leveraged a confluence of increased demand from the spot Bitcoin ETFs and bullish sentiments to print a massive market run. The crypto asset rallied 74% from a price of $39,541 on Jan. 23 to an all-time high of $69,098 on March 5.

However, upon breaching the $69,000 territory, Bitcoin recorded a massive retracement that saw it collapse below $60,000. The asset has regained most of the losses from this sudden retracement, now looking to engineer another run to breach the $69,000 territory and hold above it.

The recent market condition has left traders cautious, as expectations of another push down emerge. Amid the current market reality, crypto analyst Ali Martinez has called attention to an important price level that investors should keep a close eye on.

Bitcoin Needs to Hold $66,112

According to Martinez, Bitcoin currently boasts a formidable support at the $66,112 price, a price level with which the bulls could leverage to hedge against any subsequent price declines in Bitcoin’s price.

The key support level for #Bitcoin stands at $66,112, marked by a substantial volume of over 306,676 $BTC transactions. Should #BTC break below this pivotal threshold, eyes will turn to $60,600 as the next crucial support zone. pic.twitter.com/etuBRlvIOR

— Ali (@ali_charts) March 7, 2024

Citing data from Glassnode’s UTXO Realized Price Distribution (URPD), the analyst emphasized that the support at this price point is due to a large concentration of transaction volume. The Bitcoin URPD metric can be instrumental in identifying pivotal support and resistance points.

Notably, the metric illustrates when market participants moved some BTC tokens and at what prices they acquired them. A bar on the chart represents the amount of existing BTC created within specific price ranges. This metric helps us understand the entry points of different groups.

As highlighted by Martinez, data confirms that the Bitcoin network recorded a massive volume of 306,676 transactions at the $66,112 price.

The significant volume experienced at this level indicates strong buyer interest. This could result in the level acting as a buffer against potential downward movements amid the current uncertainty surrounding the market.

A Possible Collapse to $60,600

However, Martinez does not rule out the possibility of a breach below $66,112. According to him, should this bearish event occur, Bitcoin’s next pivotal support level would come in at $60,600. This indicates that the asset does not boast formidable defense between $66,112 and $60,600.

Meanwhile, Bitcoin currently changes hands for $67,188, having recently reclaimed the $67,000 price threshold in the recovery campaign. The asset has gained by 1.69% today, looking to secure a second consecutive winning day following the massive 6.54% decline on March 5.

Despite the possibility of a collapse to $60,600, market watchers remain confident in the long term. Recently, CryptoQuant founder Ki Young Ju argued that Bitcoin would never retest the $46,376 due to the fact that its spot ETF products began trading at this price level.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.