Bitcoin (BTC) takes the biggest hit, as crypto-focused investment products record $251 million in weekly outflows, marking the fourth consecutive week of sustained capital exit.

The ongoing market volatility has continued to impact traditional investment products linked to cryptocurrencies. According to data sourced by capital market firm CoinShares, these investment instruments witnessed a net outflows of $251 million last week.

The latest data marks the fourth straight week of sustained outflows, with the previous figure amounting to $435 million, the largest since March. These outflows have persisted despite the Grayscale Bitcoin Trust (GBTC), the major contributor, observing a decrease in capital withdrawals.

Bitcoin Only Asset to Record Outflows

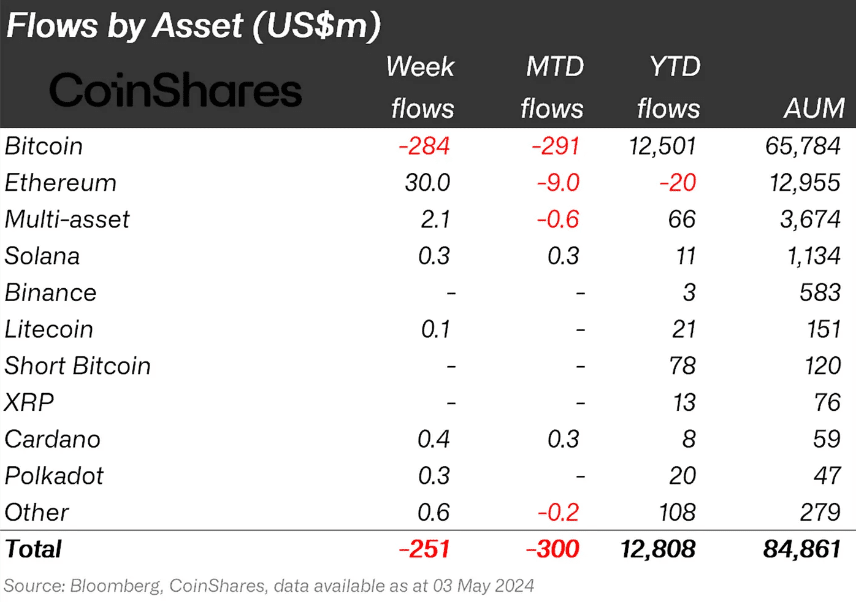

Of the indexed cryptocurrencies, Bitcoin was the only asset to experience outflows last week, totaling $284 million. In contrast, Ethereum (ETH) observed $30 million inflows, effectively ending a 7-week streak of outflows. Although altcoins, including Cardano, Polkadot, Solana and XRP, saw modest inflows, Bitcoin’s $284 million outflow eclipsed these figures.

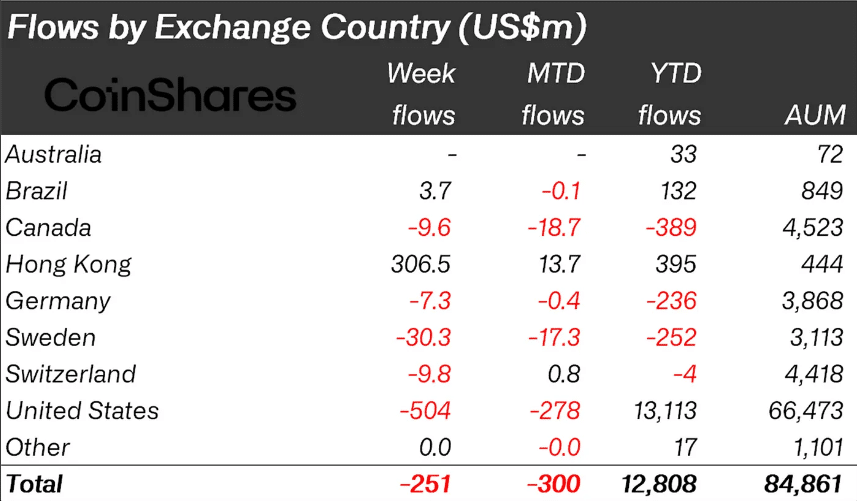

Despite the gloom, the week observed the launch of six Hong Kong-based spot crypto ETFs, as asset managers in the Asian city-state sought to replicate the success of the U.S.-based products. Before their launch, ChinaAMC divisional head Zhu Haokang expressed confidence in the potential of these products to surpass the U.S.-based ones on their first trading day.

However, they debuted with a trade volume of $112 million, far below the $4.54 billion debut volume recorded by the U.S.-based spot Bitcoin ETFs. Though the Hong Kong investment products saw declining volumes as the week progressed, they managed to scoop up $307 million in capital inflows over the week.

Performance by Region

While the recently launched Hong Kong-based spot Bitcoin ETFs bolstered the positive momentum, global capital exit overshadowed this figure, leading to the $251 million in net inflows overall. Region-wise, most of the outflows came from the U.S., which witnessed $504 million in negative flows.

Other countries followed this trend of outflows, with only Brazil and Hong Kong recording inflows. The major factor that contributed to the outflows in the United States was the underperformance of the spot Bitcoin ETFs in the country, commanding outflows of about $156 million.

However, recent data suggests that the trend is recording a shift, with this week already looking bullish. Remarkably, GBTC saw its second consecutive inflow yesterday after months of persistent outflows. In addition, yesterday marked the first time all the spot Bitcoin ETFs in the U.S. saw positive flows.

First time ever 1D flows all green, no red for the Bitcoin Bunch. Not going to spike the football like some did during the outflow period but will point out that over 95% of the ETF investors HOLD-ed during what was a pretty nasty and persistent downturn. Will same happen next… pic.twitter.com/3l3uwwmqGy

— Eric Balchunas (@EricBalchunas) May 6, 2024

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.