On the weekly chart, Axie Infinity (AXS) signals a positive short-term outlook, displaying a pattern that suggests a bullish trend.

Axie Infinity price is up nearly 9% in the last two days, breaching the $7.76 threshold on Thursday. A stable close above $8.00 could bring more gains in the short term as AXS continues to show strength amid volatile market sentiment.

AXS/USD is trading with a bullish bias. Nonetheless, in the last 24 hours, the trading volume is down by 27%, per CoinMarketCap data, suggesting a considerable decline in trading activity compared to the previous day.

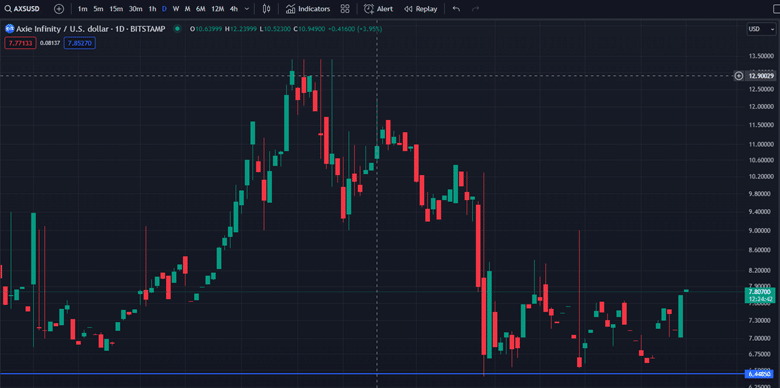

After breaking the short-term consolidation of $6.51 and $7.70, the price jumped with strong buying conviction, as seen with a green Morubozu candlestick on the daily chart. The resistance in the daily time frame stands at the April high of $8.20. In the short term, the bulls could push the price higher after the massive daily close.

The recent price action has morphed into a “Morning Star” pattern on the weekly chart, representing a bullish reversal validation.

Based on the bullish formation on the weekly chart, Axie Infinity has been steadily gaining value over the past few sessions. Analysts anticipate that it will surpass the $10.00 mark by a significant margin in the near future.

Famous analyst Ali also mentioned a bullish technical formation on the weekly chart, which gives an upside target price for the token.

#AxieInfinity appears to form an inverse head-and-shoulders pattern on the weekly chart, which anticipates $AXS to rise toward the neckline at $13 before a potential breakout to $22. pic.twitter.com/99kVKwUrwc

— Ali (@ali_charts) May 23, 2024

Do these formations justify the ascending trajectory of the price rally? If yes, then the next question is how much and when!

The recent price movement shows that the Axie Infinity price has successfully broken through the higher level and reached the key resistance area at $7.76. The next important trading zone for the price is at the trend line, which is at $10.00. To maintain the bullish trend, the price needs to sustain this level and break the trend line on a weekly basis, as the bears have often driven prices down hard after reaching that level.

Once the price manages to breach the first upside target zone, it can move further toward the $13.00 level. According to Ali, further upside would take AXS to $22.

On the lower side, the key support zone is playing around $6.65, which attracts buyers to enter the long position. If the pattern fails to sustain and the bears capture this level, the price could again enter the area of consolidation. In that case, the risk of testing the $6.00 or below would strengthen.

Technical indicators, Support and Resistance

RSI trades below 50. Hence, validation is required for the prices to continue on the upward trajectory. MACD coincides with the central line, showing a neutral bias at the current price movement.

Investors are advised to clearly wait for the key levels on a closing basis to stay invested. The current resistance level for Axe Infinity is at $7.76, while the key support zone is fluctuating around $6.65.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.