Bitcoin (BTC) faces multiple factors that could contribute to steeper price declines, as Uphold research head identifies a potential bearish double top.

Notably, the market has been on a bearish path, with BTC leading the charge. The premier cryptocurrency has shouldered losses over the past few weeks. Despite its historically bullish performance in July, BTC is already 3.71% down this month. This comes after a discouraging 7% collapse in June.

Bitcoin Forms Weekly Double Top Pattern

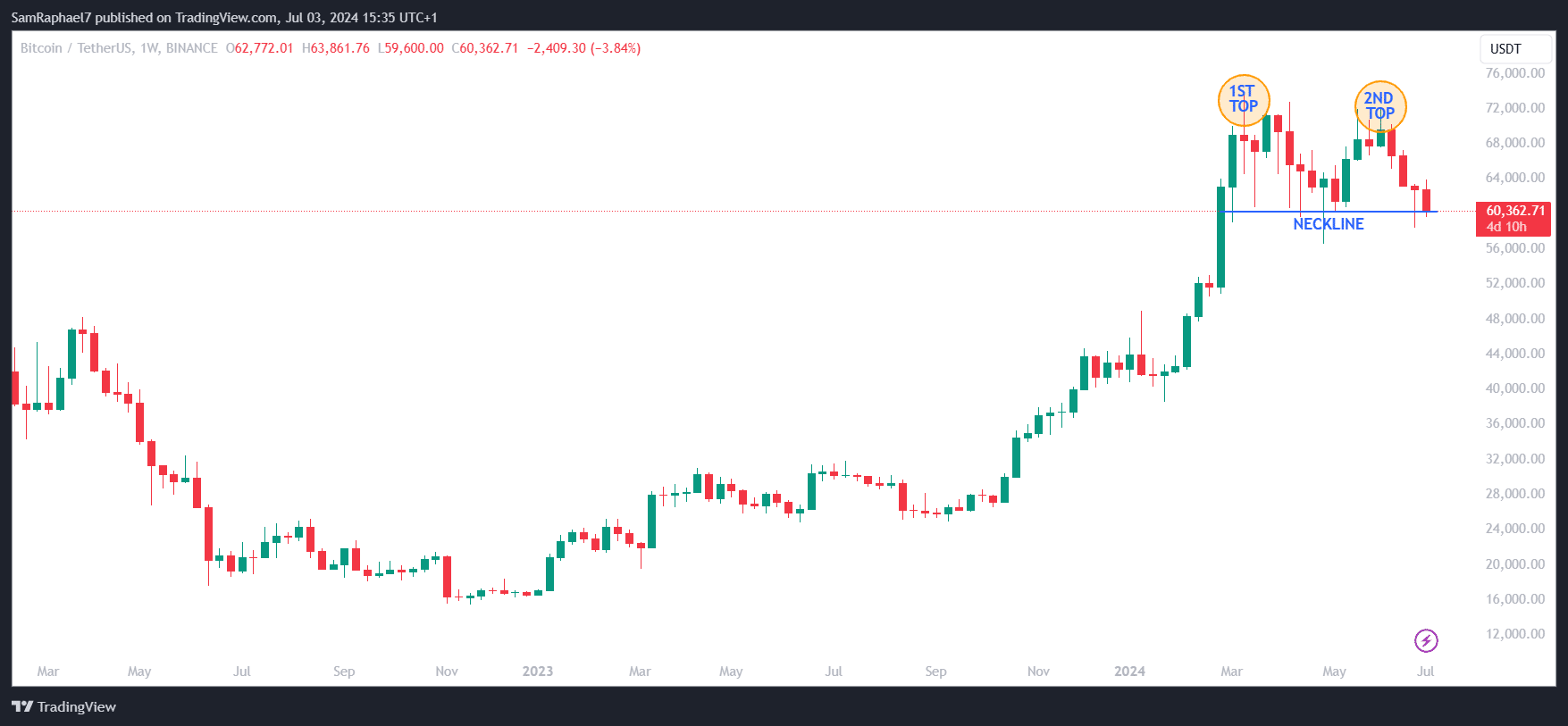

Consequently, Bitcoin hovers around the lower spectrum of the $60,000 threshold. However, industry leaders believe the downturn might not be over. Dr. Martin Hiesboeck, Uphold’s Head of Research, recently identified a double top pattern on the weekly timeframe.

Weekly double top clearer and clearer. #Bitcoin. Manage your risk. pic.twitter.com/oBivvpAsHW

— Dr Martin Hiesboeck (@MHiesboeck) July 3, 2024

For the uninitiated, a double top is a bearish setup that indicates potential sustenance of a downtrend. It forms when an asset’s price reaches a high point twice, with a moderate decline between the two peaks. If the price subsequently falls below the level of the intervening low, it confirms the pattern and suggests further decline.

The first top for Bitcoin came up when the asset surged to the all-time high of $73,873 in mid-March. After this, it experienced a moderate drop, and then clinched the second top when it soared to $72,000 in early June. Despite this, the pattern remained uncertain, as BTC had not dropped to the neckline around $60,000.

However, amid the recent price declines, Bitcoin has retested the region around the neckline, currently trading for $60,362. According to Dr. Hiesboeck, the latest development makes the weekly double top pattern clearer. As a result, the chances of a set of steeper declines could be high. He urged investors to manage their risks appropriately.

Factors that Could Contribute to More BTC Declines

Notably, the market is currently facing multiple factors that could contribute to the expected declines. One such factor is a trend of sustained selloffs. Lookonchain recently spotlighted a whale that has consistently moved millions in BTC to Binance. The address recently transferred 1,023 BTC worth $62.2 million to the exchange, bringing his total deposits to 1,723 BTC ($106 million) in the last 24 hours.

The whale deposited 1,023 $BTC($62.2M) to #Binance again 45 minutes ago.

The whale has deposited 1,723 $BTC($106M) to #Binance in the past 24 hours.

And the price of $BTC has dropped by ~3% in the past 24 hours.

Address:

1J22CPni1EsmT15A9qveydfWMoPMRw9Lp3 pic.twitter.com/mLuvCSNlAv— Lookonchain (@lookonchain) July 3, 2024

The surveillance resource earlier spotted a similar whale deposit involving 1,200 BTC valued at $73.4 million to Binance on June 27. Another whale wallet that had remained dormant since 2018 also recently awakened to move 1,000 BTC to Coinbase.

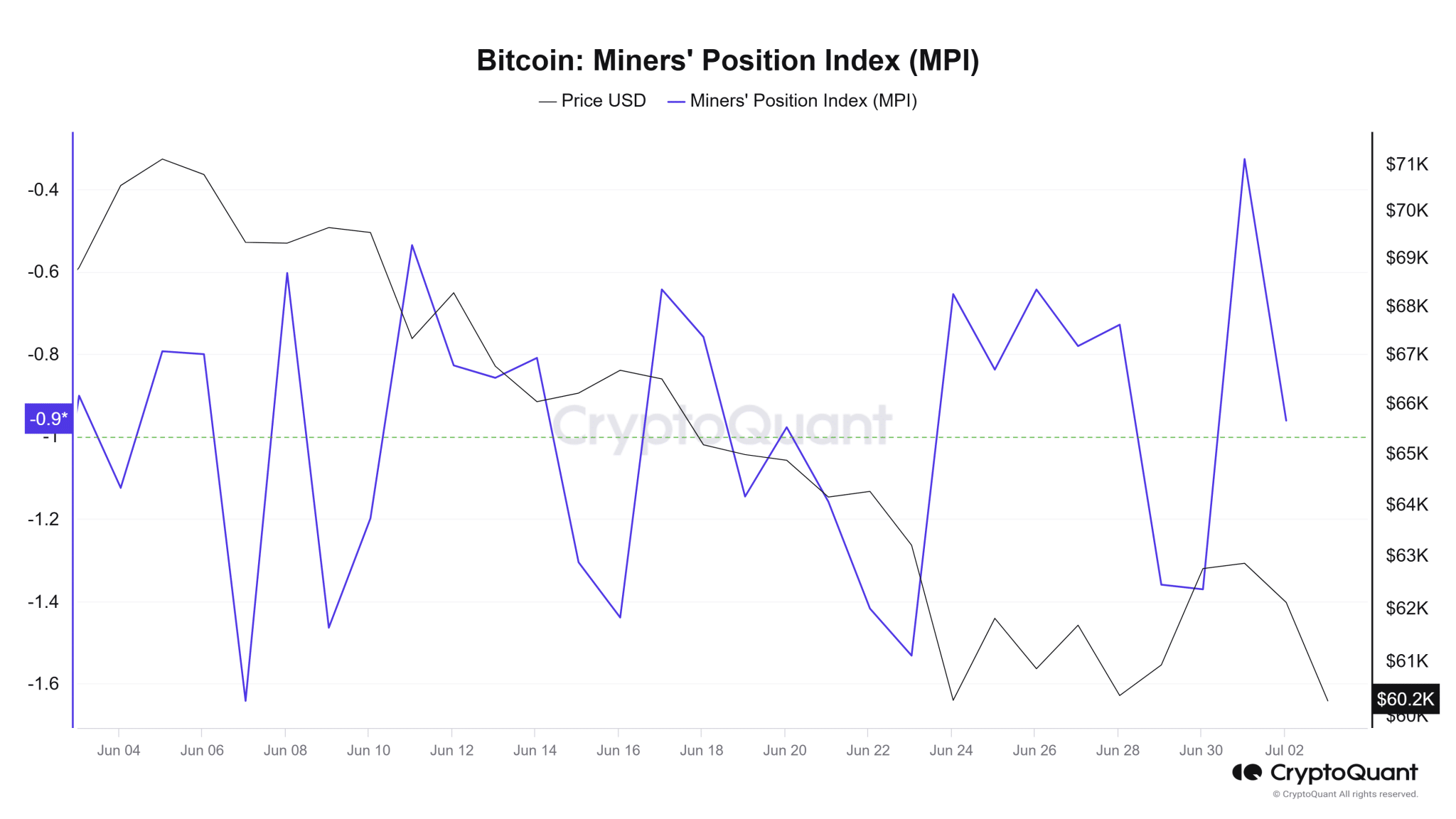

Moreover, The Crypto Basic reported last Thursday that a Bitcoin miner dormant for 14 years had deposited 50 BTC to Binance. Another report on June 12 suggested that leading Bitcoin miner Marathon Digital recently sold off 1,000 BTC. Notably, the Bitcoin MPI spiked to a 1-month high of -0.326, showing that miners were selling off their holdings.

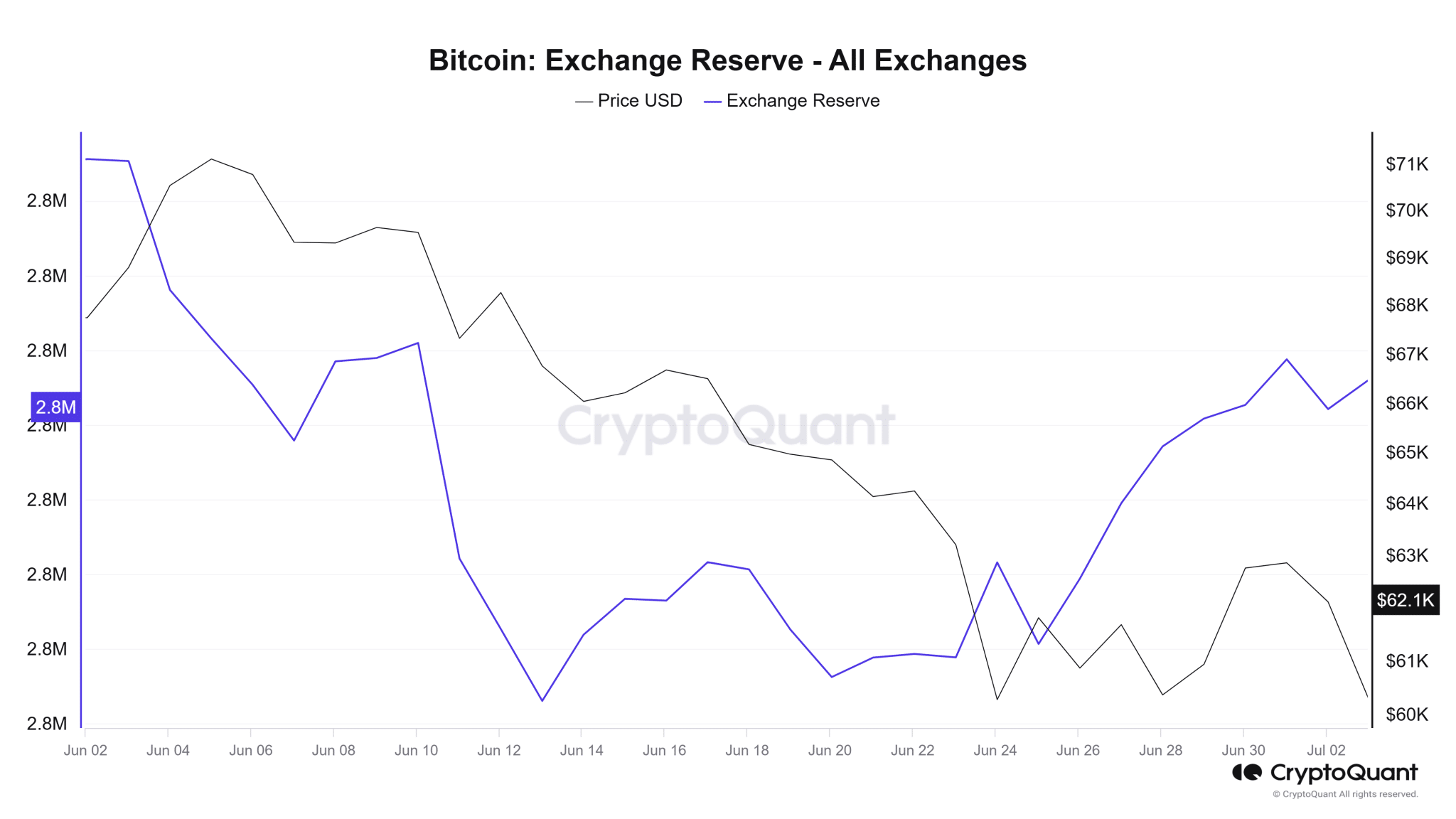

These increased deposits have reflected in the Bitcoin balances held by exchanges. CryptoQuant confirms that Bitcoin’s Exchange Reserve has increased to 2.841 million tokens, the highest in nearly a month. This trend contributes to increased selling pressure, further compounding selling pressure.

In addition to the whale and miner selloffs, the German government recently moved additional 400 BTC to Coinbase and Kraken. Moreover, Bitcoin recently decoupled from the bullish U.S. equities. As a result, the crypto asset has retained its bearish trend.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.