Ethereum ETFs are now gaining traction as traditional finance (TradFi) institutions ramp up investments amid a rebound in daily netflows.

The positive shift in netflows syncs with recent market trends, as confirmed by Kaiko Research. While Ethereum’s year-to-date performance lags behind Bitcoin, it briefly outpaced the leading cryptocurrency in November.

Ethereum’s price has climbed nearly 40% since late October, bolstering interest in related financial products. Notably, ETH largely consolidated from Nov. 21 to 26, but recently rebounded, ending yesterday with an impressive 10% gain to reclaim the $3,500 region.

TradFi Firms Invest in Ethereum ETFs

Traditional financial firms are driving this surge. Institutional players, including major hedge funds and investment managers, are increasingly allocating capital to Ethereum ETFs.

Firms like BlackRock and Grayscale lead this charge, presenting diverse options for exposure to Ethereum. BlackRock’s Ethereum ETF (ETHA) is particularly notable, attracting massive interest from prominent financial institutions.

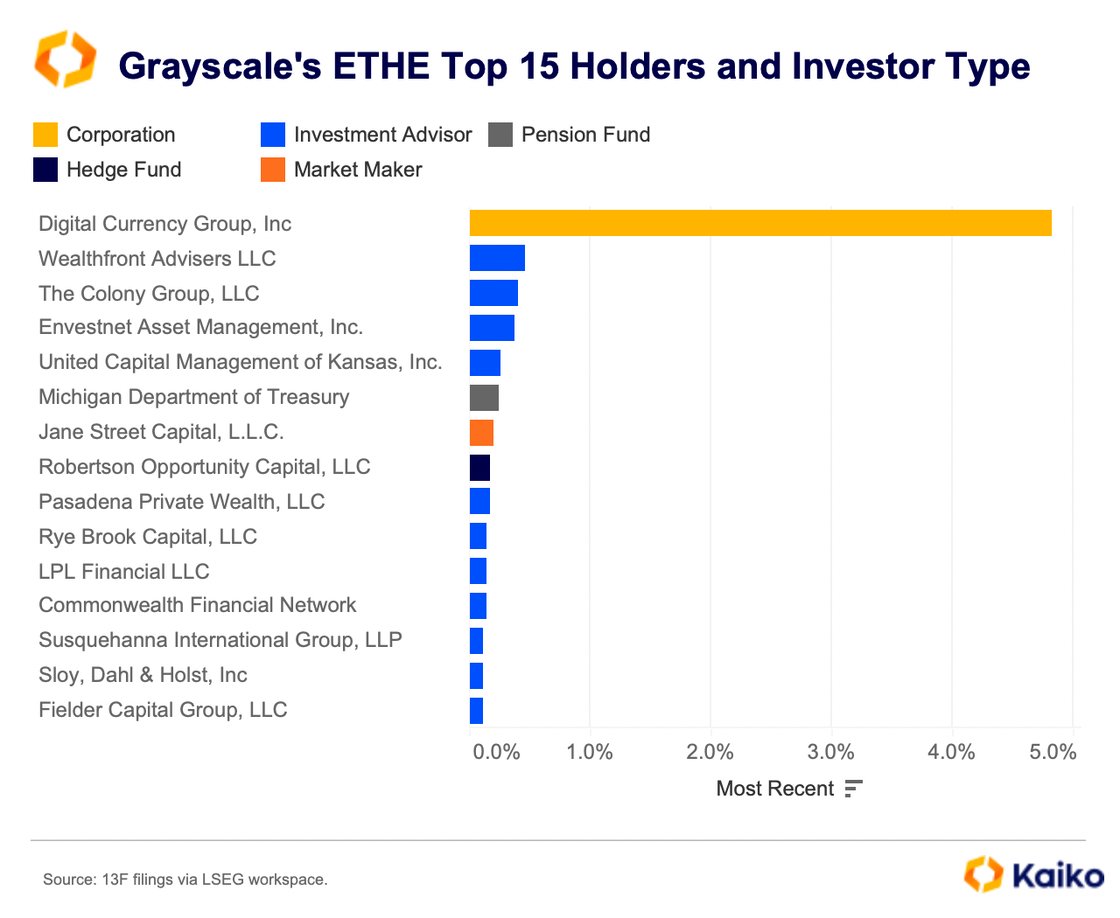

Notably, data from the recent 13F filings shows that Michigan’s state pension fund holds Grayscale’s ETHE shares. Digital Currency Group, the parent of Grayscale, remains the top holder of ETHE. Other major holders include Wealthfront Advisers and Colony Group LLC.

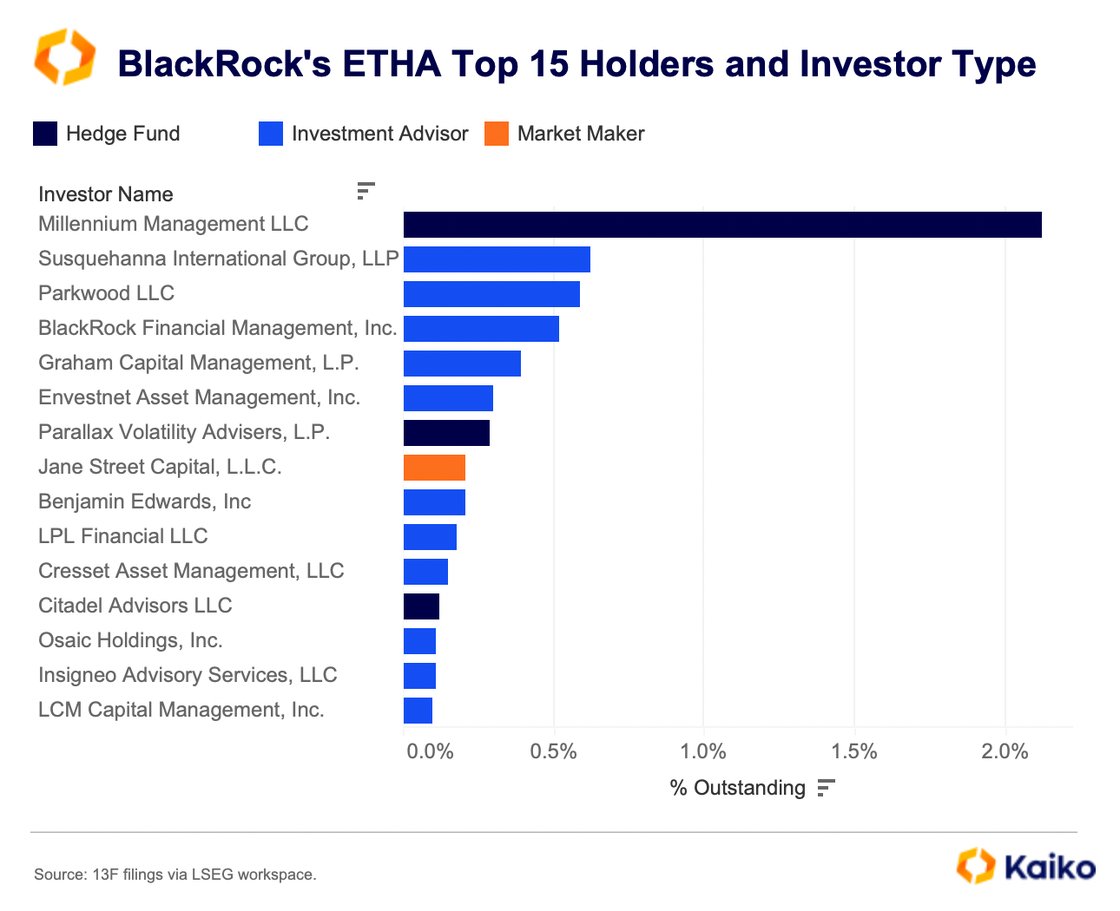

Conversely, BlackRock’s ETHA ETF attracts a different mix of investors. Millennium, a $70 billion hedge fund, is the largest holder of ETHA. Susquehanna International Group and Parkwood LLC also rank among the top investors.

Ethereum ETF Netflows Turn Positive

Meanwhile, according to market data from Sosovalue, inflows into Ethereum spot ETFs recently turned positive, signaling increased confidence in the asset class. This comes after a challenging period of outflows, followed by a sharp recovery.

Between Nov. 18 and 21, total netflows into Ethereum ETFs experienced significant outflows amounting to $162 million. However, beginning November 22, the trend reversed.

Netflows surged by $224.81 million, with $90.10 million in inflows recorded on November 27 alone. Cumulatively, Ethereum ETFs have garnered $240.41 million in inflows, indicating growing institutional interest as Ethereum prices rise.

The recovery in netflows shows growing adoption of Ethereum ETFs as a vehicle for institutional exposure. As Bitcoin ETFs have gained traction, Ethereum ETFs are beginning to follow suit.

While Ethereum futures on platforms like CME still trail Bitcoin in trading volume, increased participation from major financial firms may drive growth.

Total trading volumes for Ethereum ETFs have mirrored the recent inflows, as market activity picks up. On Nov. 27, Ethereum ETFs recorded $881.61 million in total trading value, the highest in recent weeks. Total net assets now stand at $10.80 billion, confirming the expanding market share of the asset class.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.