A study by Murray Rudd projects Bitcoin reaching higher levels by 2027 under all supply withdrawal scenarios, driven by constrained supply.

Bitcoin experienced moderate volatility over the past week, with a brief yet notable downturn late in the week. Prices began strong, surging to nearly $110,000 before correcting sharply on June 12–13. This correction brought Bitcoin down to slightly above $103,000. As of Monday, however, the asset had begun recovering, trading around $106,603.

Despite the recent price fluctuation, long-term projections from a recent study suggest a dramatically different trajectory under specific market constraints.

Long-Term Price Models

One such study is a forecast report by Murray Rudd, recently shared by Joao Paulo Mayall, founder of QR Capital, which launched the first Bitcoin ETF in Latin America. Specifically, it presents Bitcoin price projections until April 2035, based on various rates of daily withdrawals from circulating supply.

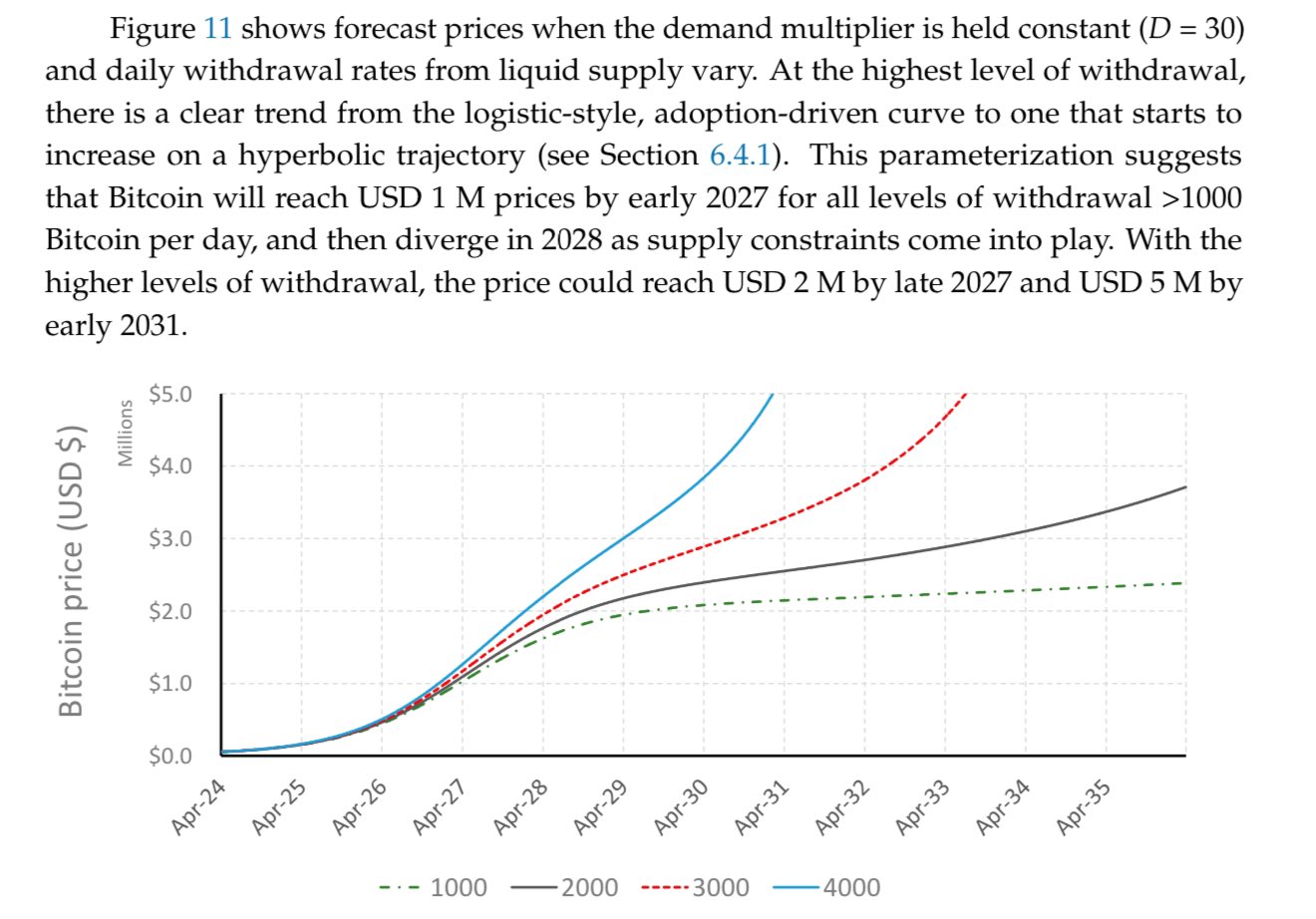

The study assumes a constant demand multiplier of 30, simulating increasing demand pressure on a declining supply. The chart outlines four withdrawal scenarios: 1,000 BTC/day, 2,000 BTC/day, 3,000 BTC/day, and 4,000 BTC/day, each showing distinct price paths.

Notably, all the scenarios display an early acceleration in price growth starting in 2024. By mid-2026, prices converge across all models near $444,000. In early 2027, the projections continue this alignment, showing all scenarios reaching close to $1 million. However, by late 2027, the models diverge as higher withdrawal scenarios lead to faster price growth.

Under a 3,000 BTC/day scenario, projections reach around $2 million. In the 4,000 BTC/day case, the price extends further to approximately $2.2 million by that same time. By 2031, the 4,000 BTC/day model shows Bitcoin surpassing $5 million.

Notably, from its current level of $106,603, Bitcoin would need to rise roughly 316.5% to reach the $444,000 milestone estimated for mid-2026.

Broader Industry Projections

Several industry leaders have echoed projections similar to those in Murray Rudd’s model. For one, Strategy’s executive chairman, Michael Saylor, recently stated in an interview with Bloomberg that Bitcoin is unlikely to revisit a bear market phase in the near term. He argued that the asset has passed its most volatile stage and is now heading toward long-term price levels between $500,000 and $1 million.

BTC Inc.’s Chief of Staff, Brandon Green, also highlighted structural shifts in Bitcoin accumulation, suggesting that this cycle may not follow the typical one-year correction seen in previous four-year patterns.

Green predicted that this ongoing cycle could continue until the end of 2026 or early 2027, with Bitcoin reaching as high as $1 million, citing accelerating institutional adoption and fiscal policy changes as key drivers.

Similarly, Binance’s former CEO, Changpeng Zhao, has projected a $1 million Bitcoin price target by the end of the current cycle.

Market Signals Suggest Lower Selling Pressure

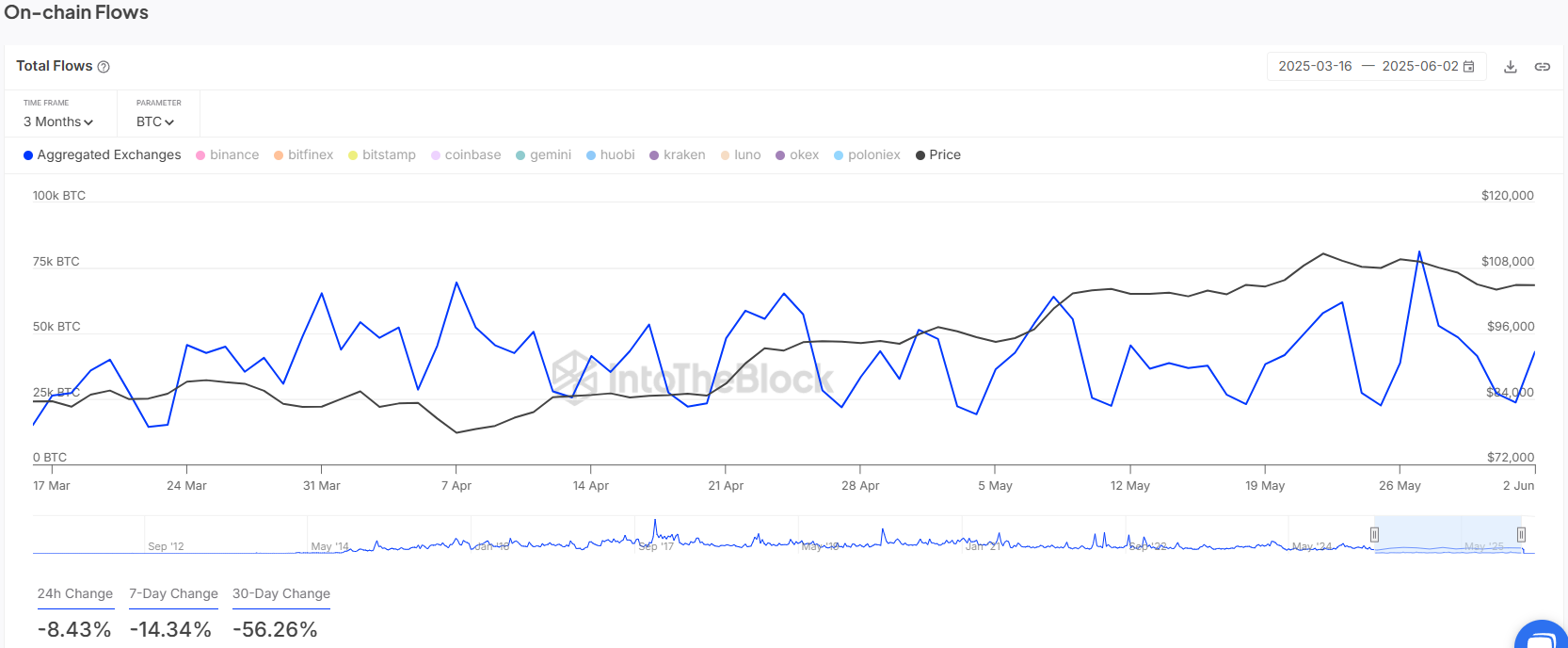

Alongside these projections, recent on-chain metrics suggest a shift in market behavior. Data from IntoTheBlock highlights a consistent reduction in Bitcoin exchange inflows over multiple timeframes.

Over the past 30 days, the net flow of Bitcoin to exchanges dropped by 56.26%. The 7-day and 24-hour periods also showed similar declines of 14.34% and 8.43% respectively.

This trend may indicate reduced selling pressure, as fewer coins are being sent to exchanges. While the study focuses on long-term models, these short-term signals provide additional context to supply dynamics and price movement.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.