Eric Trump, the pro-crypto son of the US president, has responded to criticism of his February Ethereum recommendation following the recent ETH price surge.

The rebound comes just over two months after ETH hit a low of $1,573. Eric Trump aimed his latest post at crypto commentator Ashley D Can, who had publicly mocked his earlier call.

How am I doing now @AshleyDCan? You really ought to get out of this business… https://t.co/IdesciS8Yr pic.twitter.com/hZD28xTWpB

— Eric Trump (@EricTrump) August 12, 2025

Eric Trump’s February Recommendation and June’s Criticism

Notably, on Feb. 3, Eric Trump took to X to encourage investors to buy Ethereum, expressing confidence that the move would pay off in the future. At that point, Ethereum was trading at $2,919.

The remark attracted attention from the cryptocurrency community, with some agreeing and others skeptical of the timing.

In a twist of events, ETH’s price fell sharply to $1,573 by June 3. Ashley responded to Trump’s February post by warning that those who followed his advice had served as “exit liquidity,” suggesting that the call had benefited others selling at higher prices.

August Recovery and Eric Trump’s Response

Interestingly, Ethereum’s price has more than doubled from its June low. As of this, ETH is trading at $4,696, a 7% surge in the past day. The Ethereum rally has now seen a 31% and 54.2% surge in the past week and month, respectively, in what Benjamin Cowen dubbed the Ethereum season. Notably, Ethereum is now closing on its all-time high $4,891 recorded in November 2021.

Eric Trump has now responded to Ashley, questioning her earlier criticism and suggesting she should reconsider her place in the industry.

Notably, this is not the first time Eric Trump has come out hard on anyone against Bitcoin and Ethereum. Last week, Trump expressed satisfaction over Ethereum short sellers facing losses, warning that betting against Bitcoin and Ethereum would end badly for traders.

His position came as Ethereum climbed past the $4,000 mark, its highest since December 2024, triggering the liquidation of roughly $105 million in short positions.

What’s Fueling the Ethereum Surge?

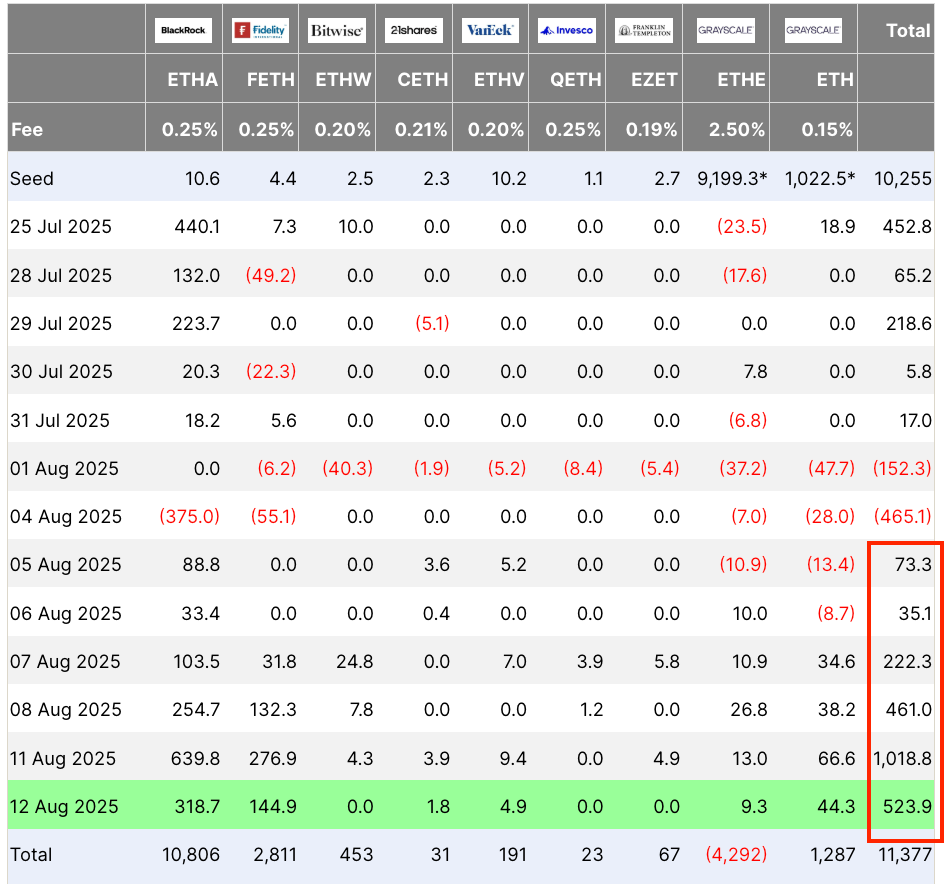

Investors’ demand for Ethereum has surged, marked by six consecutive days of spot ETH ETF inflows totaling $2.3 billion, including a $1 billion single-day record on Monday. This gives Ethereum a $1.5 billion lead over spot BTC ETFs since July.

Corporate treasuries now hold more than $16.5 billion in ETH, spearheaded by BitMine Immersion Technologies’ 1.2 million ETH position, worth $5.33 billion. SharpLink Gaming comes second with 598,800 ETH after a 177% uptick in the past month.

What is Next for Ethereum?

Meanwhile, a chart shared by analyst Jelle noted Ethereum trading above a bullish megaphone formation, with upside projections ranging from $7,000 to $13,000. He said ETH has just one final resistance level to clear, with price discovery less than 5% away, suggesting that it could soon embark on its next significant rally. Meanwhile, media personality Jake Gagain had predicted Ethereum would surge to $5,350.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.