Bitcoin, the largest crypto asset by market cap, failed to capture the levels above $64,000 again on Monday as unfavorable macroeconomics plunges sustained growth.

Optimism rose among bulls on Monday after Bitcoin surged over 4% in less than an hour to trade above $64,000. However, the bullish push was short-lived as the premier crypto asset dropped from the October 8 high of $64,413 to trade at $62,475 at the time of writing.

Despite bullish sentiments within the crypto community, Bitcoin has failed to sustainably trade at $66,000 since July. Particularly, proponents expecting an explosive run from the asset in “Uptober” have had their hopes dashed, at least for now.

However, report shows that the recent underperformance in the Bitcoin price could be tied to unfavorable macroeconomics. These factors have hindered investor traction to the firstborn crypto asset despite a growing global monetary base.

For context, the amount of money circulating globally appreciated from $104 trillion in June to $108 trillion in October, a factor that has historically driven Bitcoin’s price higher.

Cautious Approach Among Investors Driving Price Redundancy

Meanwhile, Bitcoin’s multiple rejections between $64,000 and $66,000 have stemmed from investors’ cautious approach. These doubts have been tied to uncertainties around sustainable economic growth, geopolitical tensions, and the upcoming US presidential election.

For context, Bitcoin dived towards $60,000 earlier in the month when the Middle East conflict resumed. Investors pivoted to less risky assets amidst the escalating tensions of a war outbreak.

Also, Friday’s September US jobs data release further dampened the chances of a 50 basis point (bps) rate cut from the Federal Reserve.

The employment data came in stronger than expected, with 254,000 jobs added in September against the 150,000 expected. Hence, an impending Fed resolution to keep a higher interest rate reduces investors’ risk appetite, consequently affecting exposure to Bitcoin.

Furthermore, investors are on the lookout for the upcoming November elections, which analysts have teased will have a considerable impact on cryptocurrencies. Market speculators noted that a win for pro-crypto candidate Donald Trump could lighten the mood in the crypto sector, while a converse outcome could spell a short-term downtrend.

Bitcoin Derivative Reinforces Cautious Sentiments

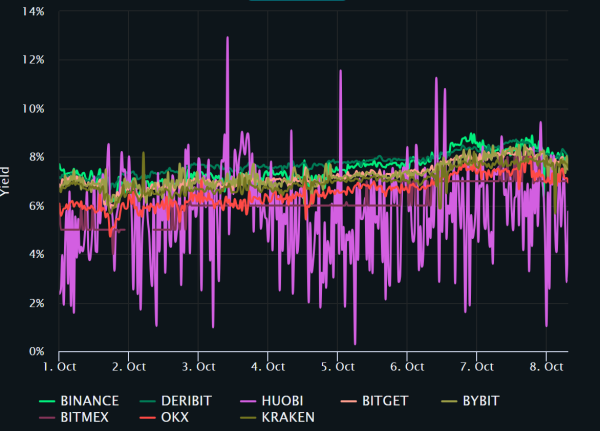

Notably, data from Laevitas further reiterates the cautious disposition of Bitcoin investors. Per the data, the Bitcoin 3-month annualized basis of investors remained neutral, signaling a lack of appetite among investors toward leveraged trading.

The data showed that the basis has remained between 7% and 8% across major exchanges. For context, when leveraged buys dominate the market, the basis usually trades as high as 15% to 20%. A neutral bias will see the contracts trade at 7% or 8%, while a bearish disposition could see a further drop in value towards zero or negative

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.