U.S.-based Bitcoin spot ETFs experienced record inflows in October, led by BlackRock’s impressive $2.11 billion boost.

October 2024 marked a significant milestone for spot Bitcoin ETFs, which saw their highest net weekly inflows since March. As the U.S. presidential elections approached, market momentum intensified, resulting in notable net gains in Bitcoin ETF holdings.

In under a year since their launch, Bitcoin ETFs have collectively amassed over 1 million BTC, valued at approximately $70 billion.

Climbing Holdings and October Gains

The accumulation trend for Bitcoin ETFs showed consistent growth leading into October. As of September 16, total holdings stood at approximately 909.36K BTC, increasing to 931.64K BTC by September 30.

October sustained this upward momentum, with mid-month figures hitting 943.77K BTC and reaching 957.32K BTC by October 14. By late October, Bitcoin ETFs collectively surpassed 1.0089 million BTC.

In less than a year since their launch, #Bitcoin ETFs have collectively amassed over 1 million $BTC, valued at approximately $70 billion. pic.twitter.com/gp3m9wUscN

— Ali (@ali_charts) November 4, 2024

BlackRock’s Surge and Industry Impacts

In the last week of October, BlackRock’s iShares Bitcoin Trust (IBIT) reported its most substantial weekly net inflows since March. The net inflows brought $2.11 billion into the market, as highlighted by CryptoQuant’s CEO, Ki Young Ju.

This influx highlighted BlackRock’s pivotal role in fueling the growth of Bitcoin ETF holdings and its potential impact on the broader market. The increased flow indicated strengthened investor confidence and interest during a crucial pre-election period.

Price Trends and Sustained ETF Interest

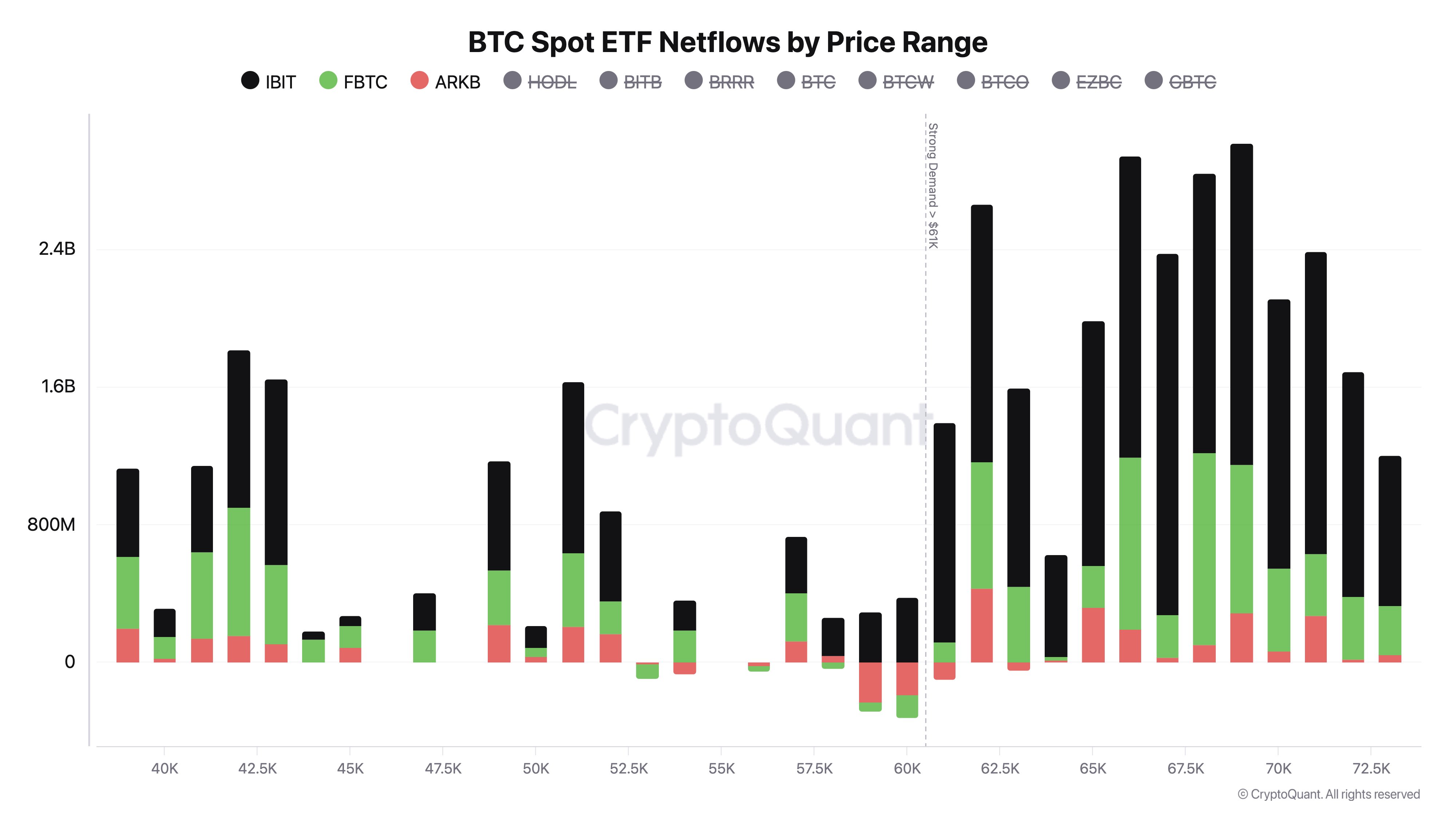

In a follow-up commentary, Young Ju highlighted how demand for Bitcoin spot ETFs has consistently grown when the asset’s price remains above key thresholds. For instance, the accompanying chart shows that the average net flow for ETFs of BlackRock, Fidelity, and Ark Invest was notably higher when Bitcoin’s price was between $65K and $70K.

Young Ju emphasized that spot ETF inflows have remained mostly positive when Bitcoin trades above $61K. This trend suggests a pattern where higher Bitcoin prices above this mark support increased demand for Bitcoin ETFs.

As of this report, Bitcoin (BTC) is priced at $68,295.51, reflecting a 0.62% increase over the past 24 hours.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.