As uncertainty grips the crypto market, Bitcoin is witnessing an intense reduction in non-empty wallet addresses, which may signal a bullish turnaround.

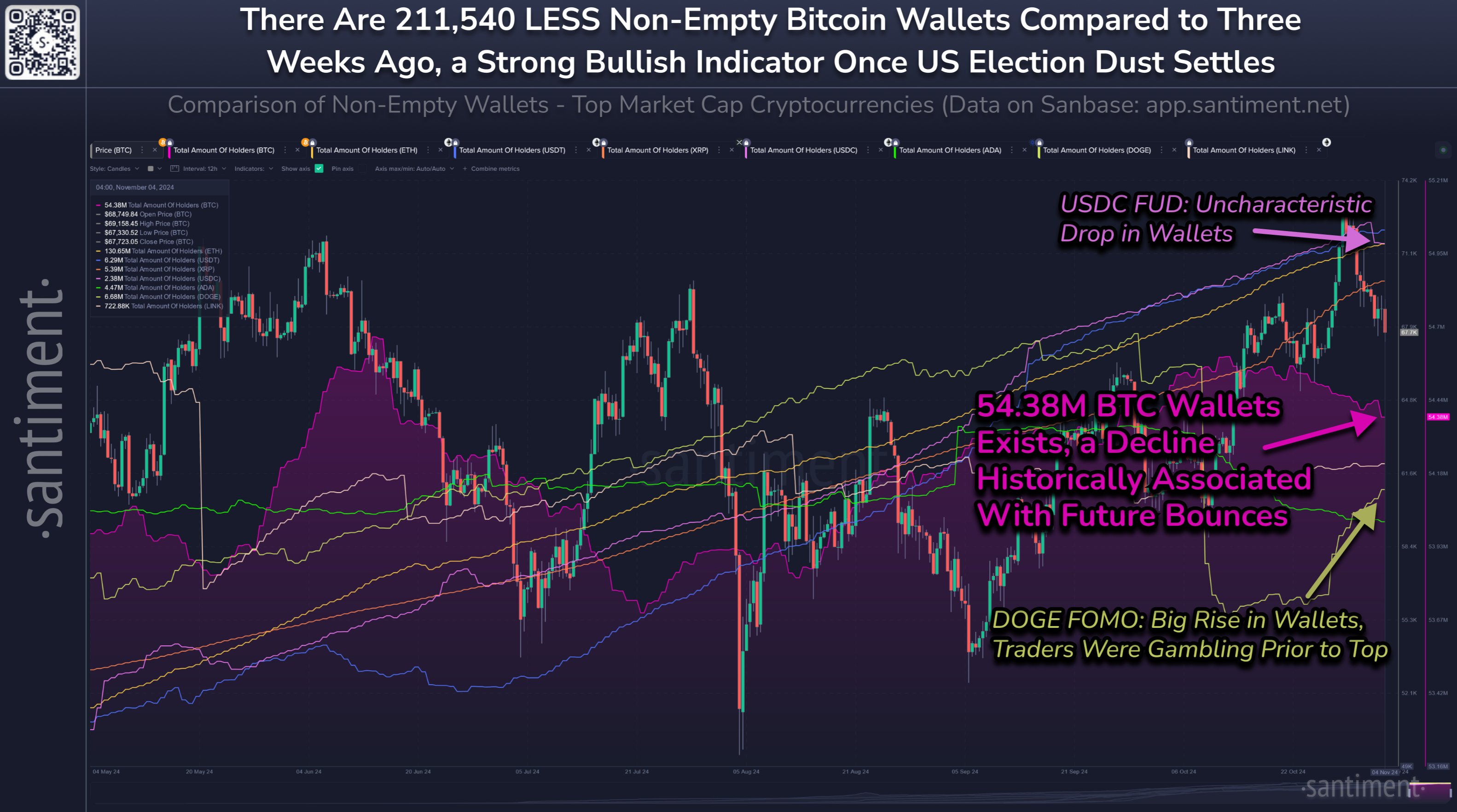

According to market analytics platform Santiment, there are now 211,540 fewer active Bitcoin addresses compared to three weeks ago. However, the analysis suggests that this trend may precede a price rebound for Bitcoin.

Investors Cautiously Exiting the Bitcoin Market

Santiment attributes the recent drop in non-empty Bitcoin wallets to a wave of fear, uncertainty, and doubt (FUD) among investors, prompting some to move funds out of their wallets in anticipation of potential short-term volatility.

Notably, Bitcoin and the broader crypto market flipped bearish over the weekend, with BTC dipping below $68,000. The downtrend intensified today as Bitcoin revisited $66,803 before quickly rebounding to $68,900.

In addition, analytics platform IntoTheBlock highlighted that long-term Bitcoin holders are reducing their positions, although at a slower pace than in past bull cycles. This moderate sell-off signals a shift in investor behavior, with caution prevailing over aggressive exits.

It suggests that investors are hedging their positions instead of abandoning Bitcoin entirely, likely indicating a new cycle dynamic amid the current market uncertainty.

This chart shows long-term Bitcoin holders' balances.

This cycle marks some clear differences from previous ones. While long-term holders are selling, it's less aggressive than in past bull peaks.

This moderate sell-off suggests a shift, with investors showing caution about… pic.twitter.com/Qi0MzNC8pJ

— IntoTheBlock (@intotheblock) November 4, 2024

Current FUD as a Potential Bullish Signal

With active Bitcoin addresses now down to 54.38 million, Santiment noted that market recoveries have historically followed declines like this. The firm posited that a renewed buying interest could trigger upward momentum once the selling pressure eases and the “dust settles” from the U.S. election.

Uncharacteristic Behavior in Other Crypto Assets

Additional data from Santiment shows uncharacteristic behavior in other crypto assets as well. The USDC stablecoin, for instance, experienced a drop of 11,600 wallets in a single day over the weekend. This decline in USDC wallet activity adds to the broader market caution amid ongoing election-related uncertainty.

On the other hand, Dogecoin saw a spike in wallet activity, with 46,400 new wallets created in just one week. This surge indicates renewed speculative interest in meme coins, even after Dogecoin recently reached a local price peak. Santiment interprets this rise in Dogecoin activity as traders “gambling” on the asset, driven by FOMO (fear of missing out).

Overall, the decline in Bitcoin wallets and the reduced activity in USDC could be setting the stage for a market recovery once the current uncertainty clears.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.