Welcome to the new Bybit review; in this article, I’m going to show you exactly how to use the Bybit exchange.

The overview is how to use the interface, a few tips and tricks going into short, and Long’s and leverage explained thoroughly as possible.

Then we’re going over different order types; you will learn how to use limit orders, market orders, and use a stop loss appropriately.

We’re going to discuss conditional orders as well, and then we’re looking at the contract versus mark price. It’s imperative to know the difference.

And also, it’s crucial what price is responsible for your liquidation. Then we’re talking about funding and fees. What do you have to pay when you have to pay it, and how can you save some of the costs may be.

Now let’s jump right into our Bybit Review.

Bybit is a derivate crypto exchange that is based in Singapore and started in 2018. Bybit offers leverage trading up to 100x. Bybit offers its services to most world countries, and other than English, Bybit is present in Korean, Japanese, Simplified and Traditional Chinese, and Russian languages.

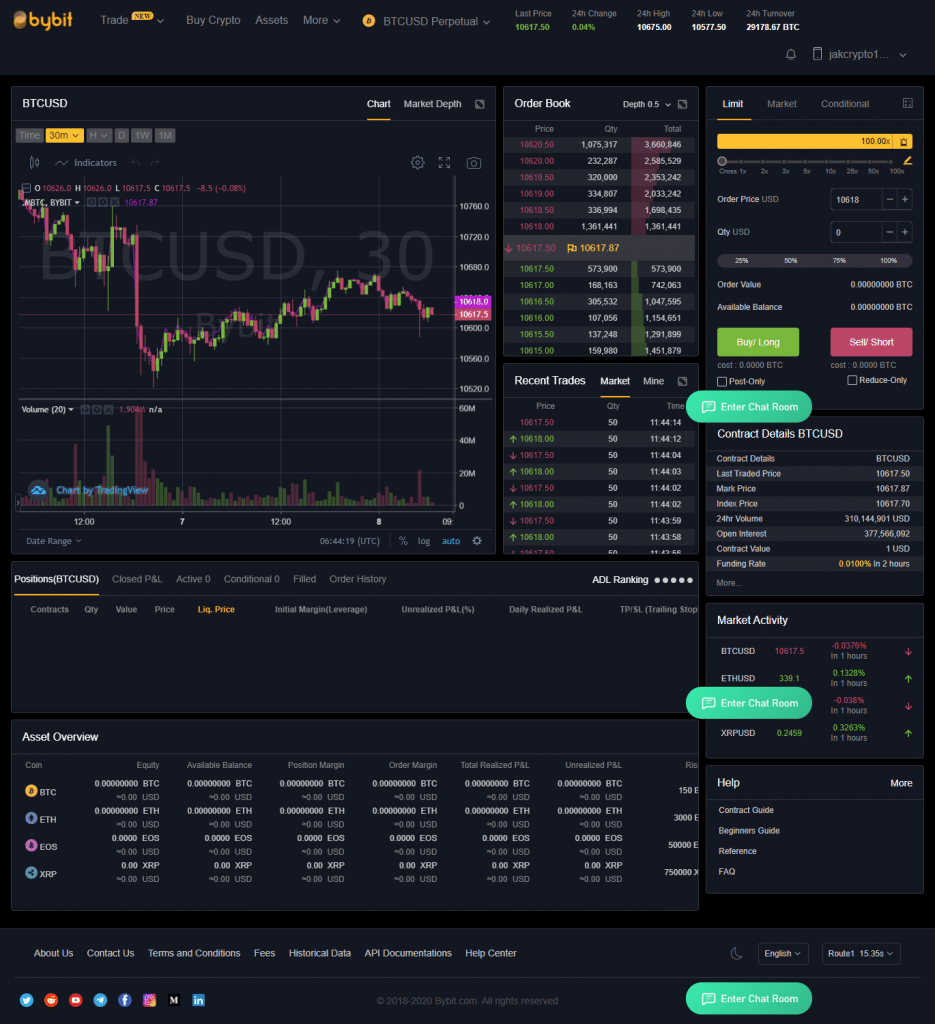

Bybit Interface

Bybit is quite good as far as the design is concerned. It is very responsive, and you can drag all these boxes in whatever position you want to have them, so it fits perfectly for you.

For your trading style, by default, the box is the price section where you can also see your entry price and your stop-loss.

In this case, this is only a light version from the trading view. If you want to do your complete technical analysis on the trading view, there is a ticker called BTC USD perpetual futures contracts from Bybit.

Here you can do the technical analysis on real trading view, and then, later on, you can lock in your trades. So far, you cannot do that directly from the trading view.

But just to let you know, yes, there is a ticker that symbolizes the perpetual contract price on the very top.

Then we have assets closed, P&L assets history, order history, trade history, and withdrawal history.

Especially trade history for all those people who want to analyze how much they’re paid for fees and funding, make sure you check out trade history here you can see everything perfectly fine, and you can do your due diligence.

If you’re not quite sure what you’re paying, Bybit also has an FAQ section and is quite essential.

If you have any questions, pretty much every question you’re going to ask will get answered in the help or the FAQ function.

Bybit is one of the only leverage exchanges where you cannot only send Bitcoin. You can also send Ethereum and trade ETH on the platform and even withdraw it. So here you can swap between BTC, ETH, EOS, and XRP perpetual swaps.

Then we have the order book where you can see the spread and the contract price on the left side and on the right side the marked price.

We’re going to discuss those in one of the future points here in this article.

But to point it out where you can find them and here on the top right-hand side, you can see the different order types limit orders, market orders, and conditional orders, including stop losses.

Also, here you can find the contract details. For example, if you hover over the funding rate, you can see the funding rate in hours.

Short And Long Leverage Explained

Bitcoin leverage trading means that you can trade a higher volume as you have.

Let’s say, for example; you want to bet on the price of Bitcoin with one Bitcoin, you can set up a 10x leverage that means you’re actively trading ten Bitcoin so if the price of Bitcoin goes up by 10%, you’re not just making 10 percent gains 0.1 Bitcoin of your initial one. Still, you’re making 100 percent profits because of your 10x leverage. You will earn one more Bitcoin along with your initial investment of 1 Bitcoin.

But what if the price of Bitcoin moves in the opposite direction. Instead of making one Bitcoin, you will lose your initial balance of 1 Bitcoin, and your account will liquidate.

You can’t keep the 10 Bitcoin you borrowed to make your leverage trade, but you can keep the full gains.

Once again, with one Bitcoin 10x leverage, Bitcoin’s price moves up by only 10 percent. You’re making one full Bitcoin and not just 0.1 Bitcoin.

Now probably you’re asking yourself, hey, wait for a second, why would anyone borrow me those Bitcoin.

Well, this comes along with some risks. The higher the leverage, the higher the risk.

Suppose Bitcoin’s price decreased by approximately 10% because we are going long, and Bitcoin’s price would go in the opposite direction. In that case, we’re going to get liquidated at a certain level not to lose more than we have in our isolated margin.

But we’re going to lose our whole margin, so in this case, our real Bitcoin.

If it would have bettered one so let’s say once again we’re going along with one Bitcoin and the price of Bitcoin is not going up by 10%, but down by 10% and hits our liquidation price, we’re going to get liquidated, and we’re going to lose the one Bitcoin.

So yes, leverage trading can be quite profitable, but you can lose everything.

Orders Types

In market orders, you’re market maker; you’re just pressing the market buy button or market sell button, then you are a market taker.

Stop loss

Everyone has to use stop losses, and yes, you heard that right. You have to use stop-loss always above your liquidation price.

You never want to get liquidated. You also want to get stopped out if the trade is not going in the direction you plan.

If the trade is going down after two-three four percent, you want to stop out of the position depending on your technical analysis.

When we have our position open, we can see our entry price, we can see our gains, and what we also can see our stop price.

So if the price of Bitcoin is going up, the unrealized P&L will get green; we’re going to get into profits.

If Bitcoin’s price is coming down from our entry price, the unrealized P&L will turn red, indicating we are in loss.

Limit orders

Now let’s talk about limit orders.

If you want to go long, you’re betting on Bitcoin’s price to go up with a market order you are in immediately.

If the price goes up and you want to put in a limit order, you have to wait until the price comes down.

If the price is shooting up well, a limit order is probably not going to help you.

But if you trade long term, if you have a long-term plan, make sure you use limit orders.

We also have conditional orders.

Conditional orders you probably don’t have to use them all too often what’s the most important thing is a stop loss.

With conditional orders, what you can do is you can set a trigger price, and when you open a position after that trigger price or what you also can do is to close a position on trigger price.

You have no position open until that trigger price is going to get hit, and also, after that trigger price is reached, you can decide between a market order and a limit order.

Contract VS Market Price

Now let’s talk about the contract versus the market price.

Quite simple t the price here on the left side in the order book is the price of the actual contract, the perpetual swap’s price.

The price on the right side is the market price. This one is getting built from an average from different exchanges.

Second, what’s important here is pretty much everything is based on the contract price you buy or sell.

It’s crucial to know that your liquidation price is not based on the contract price but the market price. Sometimes, it can happen that in the order book, the contract price is plunging, and you are long, so you have a liquidation price below. You’re getting scared because the contract price is dumping, but as long as the official spot market is not pitching, you don’t have to be afraid of.

You’re not going to get liquidated. Your stop-loss is triggering based on the contract price, but your liquidation price is based on the market price that is very important to understand how is the market price getting built.

You can use the help function again here, click details, and this will pop up a window, and here you can already see the calculation.

The market price is the index price. The index price is a weighted spot market price of the exchanges Bitstamp, Coinbase Pro, and Kraken.

If Coinbase, for example, and Bitstamp have the same price, but Kraken has a way higher or way lower price, then Kraken will lose weight in the calculation.

Funding

Now let’s talk about the funding and why funding even exists every eight hours either Long’s are paying the shorts or shorts are paying the Long’s.

If there are more short-sellers, shorts are paying the Long’s to give an incentive to go along.

Suppose there are more long buyers. Long’s are paying the shorts to give an incentive for traders to go short. This is how Bybit keeps the balance.

Otherwise, you have to imagine if everyone would be going long who will pay for shorts, that’s how Bybit gives the incentive.

Just to let you know, this works pretty much the same on all the other leverage exchanges.

Look at the box on the top of the page, see the contract details, and here you can see the estimated funding rate that happens every eight hours.

So yes, if you open up your position directly after the funding and you close it before the next one, you’re not paying funding at all.

You only have your position open for approximately seven hours and 59 minutes to get funding fees if it is in your favor.

A positive funding rate means that longs are paying shorts, so currently, more people are long, and some percent of your position will get removed if you are long.

You could make money from funding

Here I can tell you from experience that you can make money just by funding fees.

I already made a fair amount of money just with funding because I was long, and pretty much the whole market was short, so I made good money only from funding.

Bybit VS Bitmex

As we all know, it is vital to have many options in trading, so what I want to do is break down for you five reasons that I think Bybit is a better leverage exchange than Bitmex.

There are quite a few, even more than five, reasons why I think it’s a better exchange, so I primarily switched to this exchange.

But I want to run you through five of my favorite ones, and I’m going to have to start with obviously the friendlier graphic user interface of Bybit.

It’s simpler than Bitmex. Bitmex has a potentially more confusing layout.

I’ll give you an example if I decided that I wanted to buy some Bitcoin, I could choose to play with percent of my portfolio very thoroughly, and I can also decide the leverage to exercise.

For example, I get ten times leverage by clicking on the leverage slider, which is very familiar. Bitmex is the same here. You do get the same leverage slider.

But what Bybit offers is the option to choose how much of your portfolio to trade with. Suppose I decide to trade with half of my balance. Just click on the half, 25%, 75%, etc. to choose my portfolio’s amount.

Another thing that Bitmex doesn’t offer where if I decide I want to make a profit when my position hits fifty percent profit. I can click on the fifty. I can choose what kind of order type to use, whether I want it to be triggered by the last price of the index price, and it auto-fills what price Bitcoin has to reach for me to make fifty percent profit, absolutely amazing.

If I’m having a 50% loss on my position, I can click on the 50% button, and it will automatically fill in the 50 percent loss.

The next thing that blew me away was the live chat support down at the page bottom, I went on to this live chat support filled in name, email address, and I asked how can I set a stop loss for conditional and literally within I want to say less than a minute I got a reply from them.

Live chat support told me about the stop loss function for conditional orders; unfortunately, such consent is not available on every exchange.

Bybit has impressive live chat support. It’s right there on the bottom right corner of the page. So it’s very easily accessible, and that’s something that Bitmex can’t offer.

If you try to look for contacting support in Bitmex, you do have the troll box, but this is a group chat for traders for trading on Bitmex.

You also have the option to email on Bybit. Faster and more straightforward if you have a simple question, very easy to get stuff done, the response time was fantastic.

The next point here, which is the community aspect. You know it’s something that you see more and more with smaller exchanges. The exchange can add things to community requests, and you guys know Bitmex hasn’t changed pretty much at all.

There is a test net exchange available on Bybit. Testnet is not a real exchange. This is the toy exchange; it helps users test their trading strategies before going for live trading.

Bitmex having better liquidity than Bybit, but you’re not sacrificing a lot, so you are getting those same benefits that Bitmex has in terms of the reliability and the stability of the exchange. Perhaps even more stable than Bitmex because you don’t get these overload issues.

You’re also getting that community support on Bybit, and one of the potentially more important things you are getting with Bybit is the withdrawal frequency.

It happens every eight hours of the day, so you’re getting three withdrawals every day on Bybit, and with Bitmex, it’s just one per day.

Another thing that I want to add on is the fact that you can deposit coins like Ethereum and Ripple and trade directly with these on a Bybit. While on Bitmex, you can only deposit BTC.

So overall you’re getting with Bybit is that flexibility. You’re getting that friendlier user interface where it’s much more comfortable, much more user-friendly setting, for example, exactly what amount of your portfolio you want to be trading within a particular trade. Exactly where you want your stop-loss to be based on your entry. I think Bybit is changing with the community’s feedback. You’re getting the live chat support, you’re getting better withdrawal frequencies, and then depositing the Ethereum and Ripple for trading.

Bybit Fees

Bybit fees are based on Market makers and takers.

Market Makers are the traders who provide depth to the order book by placing limit buy and sell orders.

Market takers are the traders who don’t place limit orders; instead, they immediately take liquidity from Bybit order books by placing market buy or sell orders or performing buy and sell manually.

| Perpetual Contracts | Leverage | Maker

Fees |

Taker Fees |

| BTC/USD | 100x | -0.025% | 0.075% |

| ETH/USD | 50x | -0.025% | 0.075% |

| XRP/USD | 50x | -0.025% | 0.075% |

| EOS/USD | 50x | -0.025% | 0.075% |

Then there are funding fees. These fees can be positive or negative and change from positive to negative daily.

Funding fees are exchanges between traders and not charged by Bybit. If Funding fees are positive, long will pay short, and if its negative short will pay long.

Bybit has no deposit fees. All deposits are free of charge. Bybit also does not charge any fees on withdrawal. But you will have to pay network or mining fees while withdrawing your coins.

To withdraw any assets, click on the withdraw button present on the applicable asset. Give your wallet address and confirm your withdrawal by 2FA.

Bybit allows three withdrawals per day. The minimum and maximum amount of withdrawal per day are:

BTC: 0.002BTC / 10BTC

ETH: 0.02ETH / 200ETH

XRP: 20XRP / 100,000XRP

EOS: 0.2EOS / 10,000EOS

Bybit App

Crypto Traders do want to keep a record of their positions all the time. It is impossible to sit in front of your trading device 24/7, so exchange apps are necessary so that cryptocurrency traders can have an eye on their open positions or open new positions whenever any opportunity arises.

Bybit app is available on android and iOS.

All advanced features present in the desktop version are available in the Bybit app. Users can very quickly open and cancel orders, view charts, analyze markets on the go.

Bybit app is available on Google play store and Apple store.

Does Bybit Require KYC

Till now, there is no KYC required on Bybit. Users can make an account by providing and verifying their email account. After creating an account, 2FA is needed for account security.

KYC is only required if the user wants to deposit fiat currency on a third-party provider platform.

Bybit Testnet

Bybit offers testnet accounts. Testnet means demo accounts. These demo accounts are outstanding for traders who want to test their trading strategies, get familiar with Bybit functions, and know-how bybit orders work.

Any user interested in the Bybit testnet can check this function on testnet.bybit.com.

Bybit Countries

Some countries cannot use the services of Bybit. These countries are Iraq, North Korea, Afghanistan, Ukraine, Crimea, Yemen, Zimbabwe, Central African Republic, Congo, Côte d’Ivoire, Cuba, Eritrea, Guinea-Bissau, Iran, Rwanda, Somalia, South Sudan, Liberia, Libya, Panama, and Sudan.

Is Bybit Safe For Trading

Before trading on any exchange, any traders will surely ask whether that exchange is safe to use or not. Not a single person will put his funds on any platform where the safety is not guaranteed.

Bybit stores user’s funds in clod storage. Such cold storage is away from the internet and offline. A significant amount of user funds are kept in these offline wallets to protect from hackers, and only some funds are held in hot wallets to fulfill user’s needs.

The funds kept in Cold storage are protected with multiple keys. All information like address, passwords are encrypted by using SSL encryption.

Bybit also protects user funds by an insurance policy. If funds get hacked, Bybit can repay all funds by their insurance.

Furthermore, to protect users, 2FA security is a must. All users are encouraged to activate 2FA before making any deposit or withdrawal from the exchange.

Is Bybit Exchange Open To US Citizens

Currently Bybit is not open for US citizens. Bybit are focusing to launch a separate platform for US citizens but there is no clear time period mentioned as how long it will take to open gates for US traders.

Conclusion

What else do you want to know any strategy or some functions I have to explain in a future article?

There is a link below for all those who want to sign up and get a ninety dollar bonus.

Make sure to check it out.

Read Informative Articles:

How To Withdraw From Binance To Coinbase Or Any Other Exchange

What is Vechain-How To Buy Vechain-Beginner Guide

How To Set A Stop Loss On Binance Futures

What is Yearn Finance (YFI) and Yearn Finance 2 (YFII)-How To Earn YFI And YFII

What is Curve Finance (CRV)-How To Earn CRV By Providing Liquidity

1inch Exchange Review And Tutorial

Uniswap Review-Complete Guide & Tutorial on Swapping & Pools

Binance Funding in Top 6 Defi Tokens-Complete Details

Best 9 Upcoming Defi Tokens Backed By Top Investors

What is Uptrennd Coin (1UP)-What Makes Uptrennd Special?

How To Set A Stop Loss On Binance And OCO Orders

Phemex Review-Exchange With Ten Times Fast Trading Engines And Zero Spot Trading Fees

7 Best Alternative To Coinbase For Trading Cryptocurrencies

How To Trade Cryptocurrency-Best Cryptocurrency Trading Strategies

what are the Top 9 Best Cryptocurrency To Invest In 2020

Best 12 Profitable Staking coins List and Exchanges

Are Trading Bots Legal? Why Use Trading Bots? Are They Profitable?

Gunbot Review-A Bot Especially Designed To Trade BTC Pairs

34 Most Recent Vechain Partnerships

Buy Bitcoin With Walmart Gift Card-How And Where?

3Commas Review-Best Crypto Trading Bot

Dogecoin Cloud Mining And Dogecoin Mining-How To Do Them Properly

Cryptohopper Trading Bot Review

What is cryptocurrency staking

What Is Cryptocurrency Mining?

What is Ethereum-How Does it Work

What is Bitcoin and How Does it Work?

How to Buy Bitcoin Cryptocurrency?

Key Points when selecting cryptocurrency exchanges

Disclaimer: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic’s opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

-Advertisement-